Get Clean Source Credit Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Clean Source Credit Application online

Completing the Clean Source Credit Application online is a straightforward process designed to gather essential information about your business. This guide will provide you with clear and concise instructions to assist you in filling out each section of the application accurately.

Follow the steps to successfully complete your online credit application.

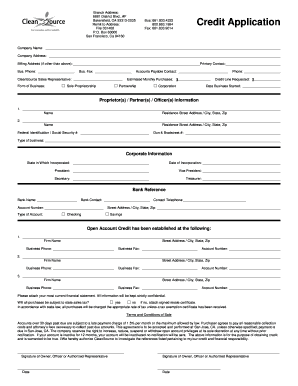

- Press the ‘Get Form’ button to access the Clean Source Credit Application and open it in your preferred editor.

- Fill in the company name and complete the company address section accurately. If your billing address differs, please enter the alternate address in the appropriate field.

- Provide the primary contact's name and business phone number. You may also include the business fax if applicable.

- Specify your CleanSource sales representative, if known, and select the form of business by checking the appropriate box: sole proprietorship, partnership, or corporation.

- Enter the accounts payable contact's name and the estimated monthly purchases your company intends to make.

- Input the credit line you are requesting and the date your business started.

- Complete the proprietor(s), partner(s), or officer(s) information section by providing names and residence addresses.

- Fill in the federal identification or social security number, as well as the Dun & Bradstreet number if applicable.

- Indicate the corporate information including the state of incorporation, date of incorporation, and the names of the president, vice president, secretary, and treasurer.

- Provide bank reference details such as bank name, contact, account number, and type of account (checking or savings).

- List the firms where open account credit has been established, including their names, addresses, and contact details.

- Attach your most current financial statement as this will be kept confidential.

- Indicate whether all purchases will be subject to state sales tax by selecting 'yes' or 'no' and attach a signed resale certificate if applicable.

- Read and understand the terms and conditions of sale regarding late payments and account inactivity.

- Sign the application in the designated areas, including your name, title, and date. If applicable, complete the authorization to release credit information.

- For the personal guaranty section, complete the necessary information, ensuring to provide proper signatures and details.

- After ensuring all sections are filled correctly, save changes, download a copy for your records, print, or share the form as needed.

Complete your Clean Source Credit Application online today to start the process.

For the solar tax credit, you’ll need to gather specific documentation such as your Clean Source Credit Application, W-2 forms, and invoices for installation costs. Additionally, keep copies of any agreements made with contractors and utility companies if applicable. This paperwork helps streamline your claims process and ensures compliance with IRS regulations. Thorough documentation maximizes your chances of receiving the credit.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.