Loading

Get Cefcu Totten Trust Designation 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CEFCU Totten Trust Designation online

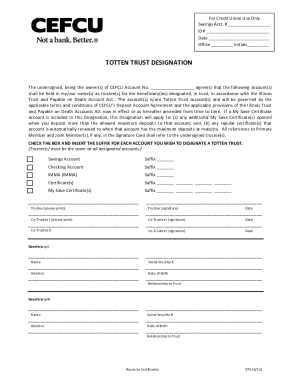

Filling out the CEFCU Totten Trust Designation form is essential for designating beneficiaries for your trust account. This guide provides clear, step-by-step instructions to help you complete the form accurately and confidently.

Follow the steps to complete your Totten Trust Designation online.

- Click ‘Get Form’ button to obtain the CEFCU Totten Trust Designation form and open it in your preferred editor.

- Enter your CEFCU account number in the designated field provided on the form.

- Find the checkbox related to account type and enter the suffix for each account that you wish to add beneficiaries. This is particularly important for certificate accounts.

- List the names of all trustees and co-trustees currently associated with the account in the specified area of the form.

- Fill in the beneficiary information for each designated beneficiary. Required information includes their name, address, Social Security number, date of birth, and relationship to the trustee. If you have more than six beneficiaries, complete a second form.

- Print the completed form to maintain a physical copy for your records.

- Ensure all current trustees sign the form before submission. Beneficiary signatures are not necessary.

- Mail the completed form to CEFCU at the following address: P.O. Box 1715, Peoria, IL 61656-1715.

Complete your CEFCU Totten Trust Designation online today to ensure your beneficiary designations are up to date.

Having a CEFCU Totten Trust Designation offers distinct advantages over simply naming a beneficiary. While both ensure asset transfer, a Totten trust allows for more control over distribution and can help manage taxes. It also simplifies the process of avoiding probate, which can be a significant burden for beneficiaries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.