Loading

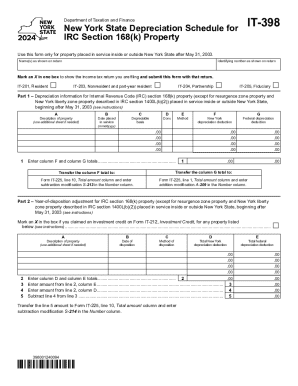

Get Form It-398 New York State Depreciation Schedule For Irc Section 168(k) Property Tax Year 2024

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-398 New York State Depreciation Schedule For IRC Section 168(k) Property Tax Year 2024 online

Filling out the Form IT-398 is essential for accurately reporting depreciation for specific property under New York State tax regulations. This guide will walk you through each section of the form, providing step-by-step instructions to ensure you complete it correctly and efficiently.

Follow the steps to accurately complete Form IT-398 online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Enter your name and the identifying number, such as your Social Security number or employer identification number, in the designated spaces on the front of the form.

- Mark an X in the box corresponding to the type of income tax return you are filing (IT-201, IT-203, IT-204, or IT-205). This indicates with which return you will submit this form.

- Proceed to Part 1, where you will fill in the depreciation information for IRC section 168(k) property. For each property, provide the description, date placed in service, the depreciable basis, method of depreciation, and calculate New York and federal depreciation deductions in their respective columns.

- Calculate and enter totals for column F and column G. Ensure that you correctly transfer these totals to Form IT-225 as required.

- If you have disposed of any IRC section 168(k) property, complete Part 2 by marking an X if you claimed an investment credit, and enter the details regarding your disposal in the respective columns.

- Calculate and enter totals for the year-of-disposition adjustment. Ensure that you accurately subtract as necessary for the adjustments in columns D and E.

- Once all fields are complete, review your entries for accuracy. You can then save changes, download, print, or share the form as needed.

Complete your documents online today to ensure timely and accurate submission.

Rates of Depreciation AssetsRates of Depreciation Residential Building 5% Non-residential Building 10% Furniture and Fitting 10% Computers and Software 40%6 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.