Loading

Get Ny It-641 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-641 online

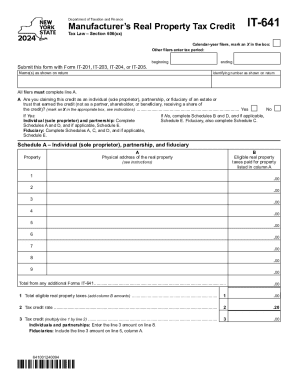

The NY IT-641 form is essential for claiming the manufacturer’s real property tax credit in New York. This guide will provide comprehensive, step-by-step instructions on how to fill out this form online, ensuring you understand each section and can complete it accurately.

Follow the steps to complete the NY IT-641 form online.

- Press the ‘Get Form’ button to access the NY IT-641 form and open it in your preferred digital editor.

- Identify if you are a calendar-year filer by marking an X in the appropriate box. If you are not a calendar-year filer, enter your specific tax period.

- Complete Section A by indicating whether you are claiming this credit as an individual, partnership, or fiduciary of an estate or trust. Mark an X in the corresponding box.

- Depending on your answer in Section A, complete the required schedules: If yes, fill out Schedules A and D (and Schedule E if applicable). If no, complete Schedules B and D (and Schedule E if applicable).

- For Schedule A, enter the physical address of the real property in Column A and the eligible real property taxes paid in Column B. Repeat this for all relevant properties.

- Add the amounts in Column B to calculate the total eligible real property taxes. Input this total in line 1 of Schedule A.

- In line 2 of Schedule A, indicate the tax credit rate, which is typically 0.20. Calculate your tax credit by multiplying the total from line 1 by the rate in line 2 and record this amount in line 3.

- Proceed to Schedule B to report the shares of credit received if you are a partner, shareholder, or beneficiary. Enter the relevant details in Columns A through E.

- Complete Schedule C if applicable, following the instructions to report details about the fiduciary's and beneficiary's shares of credit.

- For Schedule D, enter the amounts collected in the prior schedules and add them where instructed, recording your total credit in line 11.

- Finish with Schedule E, if required, calculating any credit recaptures. Enter the necessary details and totals as directed.

- Once you have filled out all required sections, save your completed form. You can also download, print, or share the form as needed.

Start filling out your NY IT-641 form online now to ensure you claim your tax credit correctly.

Calculating taxes in New York is a little trickier than in other states. The state as a whole has a progressive income tax that ranges from 4. % to 10.9%, depending on an employee's income level. There is also a supplemental withholding rate of 11.70% for bonuses and commissions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.