Get Application For Entitlement To Reduced Tax Rate On Domestic Source Income ( For Foreign Corporation) 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application for Entitlement to Reduced Tax Rate on Domestic Source Income (for Foreign Corporation) online

This guide provides detailed instructions on how to fill out the Application for Entitlement to Reduced Tax Rate on Domestic Source Income for foreign corporations. It is designed to assist users with varying levels of experience in completing the application accurately.

Follow the steps to accurately complete your application form.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

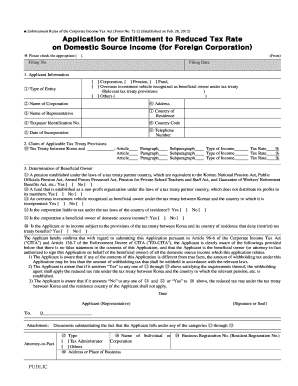

- In the 'Applicant Information' section, select the appropriate entity type by marking the corresponding checkbox. Include the name of the corporation as it appears officially.

- Provide the complete address of the corporation, ensuring that it is written in English using the correct format.

- Enter the name of the representative of the corporation, written in English as appeared in their identification.

- Fill in the taxpayer identification number or business registration number as required based on the jurisdiction of the corporation.

- Input the date of incorporation using the format YYYY-MM-DD. This ensures clarity in the corporation's establishment date.

- Include the country of residence and its corresponding country code as per ISO standards. This is crucial for tax treaty applicability.

- In the 'Claim of Applicable Tax Treaty Provisions' section, list the specific tax treaty between Korea and the relevant country, along with the applicable articles and paragraphs.

- Detail the types of income and corresponding tax rates as prescribed in the applicable tax treaty. Ensure to note if local income surtax is applicable.

- In the 'Determination of Beneficial Owner' section, answer each question truthfully. If applicable, indicate 'Yes' or 'No' based on the corporation's tax treaty eligibility.

- Confirm your understanding of the responsibilities described in the application. This includes awareness of the consequences of false statements.

- After completing all entries, review the form for accuracy. Save any changes made, and consider whether to download, print, or share the form based on your next steps.

Complete your application for reduced tax rate online today!

The withholding tax rate on KRW dividends is typically set at 22%. However, if a foreign corporation qualifies for the Application for Entitlement to Reduced Tax Rate on Domestic Source Income, they may secure a lower tax rate. Evaluating your eligibility can significantly reduce the tax liabilities on your dividends.

Fill Application for Entitlement to Reduced Tax Rate on Domestic Source Income ( for Foreign Corporation)

Without the pre-clearance, the withholding agent should apply the domestic withholding tax rates. This form must be submitted in duplicate to the withholding agent, who has to file the original with the district director of the competent tax office. Korea-source income needs to submit an "Application for. Entitlement to Reduced Tax Rate" to the withholding agent before he or she receives the income. Corporate tax shall be imposed on the following income of a foreign corporation: 1.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.