Loading

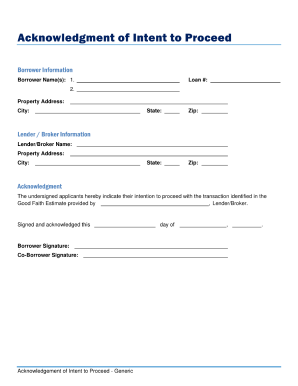

Get Acknowledgment Of Intent To Proceed

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Acknowledgment of Intent to Proceed online

Filling out the Acknowledgment of Intent to Proceed form online can be a straightforward process when approached methodically. This guide provides clear and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to access the document and open it in your preferred online editor.

- Begin by entering your full name in the designated field. Ensure that you use your legal name as it appears on official documents.

- Next, provide your contact information, including your email address and phone number. This information will facilitate communication regarding your submission.

- In the following section, indicate the date you intend to proceed. Input this information in the specified format to avoid any delays.

- Review any additional provisions or terms stated on the form. Make sure that you understand each point thoroughly before proceeding.

- Finally, save your changes once you have completed all required fields. You will then have the option to download, print, or share the completed form as needed.

Complete your documents online today for a seamless experience.

In the context of a mortgage, the Acknowledgment of Intent to Proceed shows that you are ready to engage in the application process. It typically follows pre-qualification and signals to the lender that you wish to move to the next steps. This acknowledgment helps streamline the mortgage process while ensuring that you are kept informed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.