Loading

Get Application For Exemption Form 27a (part A)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Exemption Form 27A (part A) online

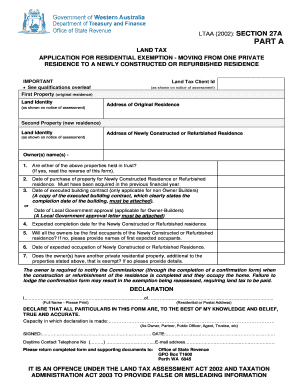

Filling out the Application For Exemption Form 27A (part A) online can seem daunting at first. However, understanding each section and providing the necessary details will facilitate a smooth application process. This guide aims to assist you in accurately completing the form for a residential exemption when moving from one private residence to a newly constructed or refurbished residence.

Follow the steps to fill out the Application For Exemption Form 27A (part A) online.

- Press the ‘Get Form’ button to access the Application For Exemption Form 27A (part A) in your preferred online editor.

- In the first section for your first property (original residence), enter the Land Identity as displayed on your notice of assessment, along with the Land Tax Client ID and the address of the original residence.

- Proceed to the second property section (new residence). Again, input the Land Identity from your notice of assessment and the address of the newly constructed or refurbished residence.

- Fill in the name(s) of the owner(s) in the designated area. If either property is held in trust, indicate this and refer to the reverse of the form for additional guidance.

- Provide the date of purchase for the new residence, ensuring it falls within the previous financial year.

- Record the date of the executed building contract if not an owner-builder, or alternatively, the date of Local Government approval if you are an owner-builder. Attach relevant documents as required.

- Specify the expected completion date for the new residence.

- Indicate whether all owners will be the first occupants of the new residence. If not, list the names of the expected first occupants.

- Enter the expected date of occupancy for the new residence.

- If applicable, disclose any other private residential property owned that is exempt, providing relevant details.

- Complete the declaration section by printing your full name and residential or postal address. Specify your capacity in which the declaration is made.

- Sign and date the declaration. Also, provide your daytime contact telephone number and email address.

- Once all information is accurately filled in, review the checklist to ensure you have completed the form and attached all necessary documents.

- Finally, save your changes, then download, print, or share the completed form as needed.

Complete your documents online to ensure a smooth filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.