Loading

Get Ow-8-p-sup-c-2002. Ow-8-p-sup-c-2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OW-8-P-SUP-C-2002 online

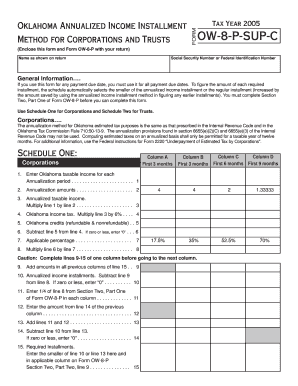

This guide provides step-by-step instructions for completing the OW-8-P-SUP-C-2002 form online. Designed for both individuals and trusts, this form is essential for reporting annualized income installments for tax purposes. Following these clear guidelines will help ensure accurate and timely submission.

Follow the steps to successfully complete the OW-8-P-SUP-C-2002 form.

- Press the ‘Get Form’ button to access the OW-8-P-SUP-C-2002 form. This will open the form in an editable format, allowing you to fill out the necessary information.

- Begin by entering the name as shown on your return in the designated field. Ensure that the name matches official documents to avoid discrepancies.

- Input your Social Security Number or Federal Identification Number in the provided section. Double-check to ensure accuracy, as this information is critical for processing.

- Review the general information section carefully. Make note that if you use this form for any payment due date, it must be used consistently for all future payments.

- Complete Section Two, Part One of Form OW-8-P as this information is required before filling out the OW-8-P-SUP-C-2002 form. Follow the instructions as outlined in the OW-8-P.

- Determine if you are filing for a corporation or a trust. Use Schedule One for Corporations and Schedule Two for Trusts as applicable.

- Fill in the applicable columns with your Oklahoma taxable income for each annualization period, ensuring you use the correct multiplier as specified for each duration.

- Calculate the annualized taxable income by multiplying your Oklahoma taxable income by the annualization amounts indicated in the table.

- Proceed to compute the Oklahoma income tax by applying the appropriate percentage based on your annualized taxable income.

- Account for any Oklahoma credits by entering the total in the specified field and subtracting this from your calculated income tax.

- Continue through the remaining fields, following the instructions to fill out required installments and ensure all calculations are clearly documented.

- After completing all required entries, review the form for accuracy. You can then save your changes, download a copy for your records, and print or share it as needed.

Complete your OW-8-P-SUP-C-2002 form online today to ensure timely and accurate reporting!

Related links form

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.