Loading

Get Nc Dor D-400 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR D-400 online

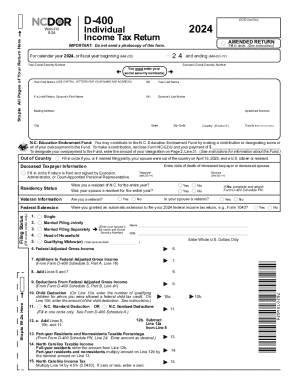

The NC DoR D-400 is an essential form for reporting individual income tax to the North Carolina Department of Revenue. This guide will provide a clear and comprehensive overview of how to complete the form online, making the process easier for everyone.

Follow the steps to complete the NC DoR D-400 online

- Click ‘Get Form’ button to access the D-400 form and open it in your online editor.

- Fill in the required personal information, including your and your spouse's Social Security Numbers, names, and mailing address. Ensure to use capital letters for clarity.

- Indicate your filing status by marking the appropriate circle, such as 'Single' or 'Married Filing Jointly.'

- Complete the income sections by entering your Federal Adjusted Gross Income and any additions or deductions from Schedule S.

- For any tax credits, complete the relevant sections and include the total in the designated areas.

- If necessary, indicate if you claimed a federal extension to file your income tax return.

- Review the information you entered for accuracy and completeness.

- Once you have filled in all sections, choose to save your changes, download the form, print it, or share it as needed.

Complete your NC DoR D-400 online today for a smoother filing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.