Loading

Get State-printing-combined Sales And Use Tax Return (with Coupon) 12-21-05.xls

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State-printing-Combined Sales And Use Tax Return (with Coupon) 12-21-05.xls online

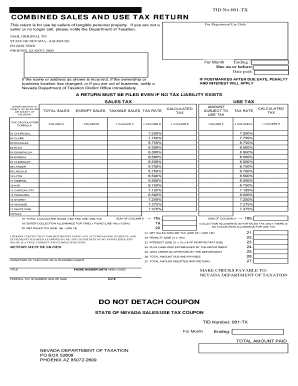

Filing the State-printing-Combined Sales And Use Tax Return is an essential process for sellers of tangible personal property. This guide provides a detailed, step-by-step approach to help users fill out the form accurately and efficiently online.

Follow the steps to complete your tax return with ease.

- Press the ‘Get Form’ button to access and open the State-printing-Combined Sales And Use Tax Return (with Coupon) 12-21-05.xls in your preferred editor.

- Locate the section for ‘TID No’. Enter your unique Tax Identification Number in the provided field, ensuring accuracy to avoid issues.

- Select the appropriate month, quarter, and year for your tax return under the 'For Month' section. Make sure to input the correct information to align with the reporting period.

- Fill out the ‘Total Sales’ section (Column A) with the total amount of all sales, excluding sales tax collected. Include all relevant sales related to your Nevada business.

- Complete Column B by entering any Exempt Sales, which are the total sales not subject to tax, such as sales for which you have received a resale certificate.

- Calculate your Taxable Sales (Column C) by subtracting the total Exempt Sales from the Total Sales. Input this figure in the respective field.

- In Column D, enter the applicable Tax Rate for your county from the chart provided. This rate will be critical for calculating your tax obligations.

- Calculate the Calculated Tax (Column E) by multiplying your Taxable Sales (Column C) by the Tax Rate (Column D), and input the result in Column E.

- In Column F, enter the amount subject to Use Tax, which pertains to any goods or services purchased without payment of Nevada tax.

- Determine the Calculated Tax for Use Tax (Column H) by multiplying the Amount Subject to Use Tax (Column F) by the applicable Tax Rate (Column G).

- Follow the instructions for lines 18 to 27 to complete the necessary calculations, including the totals, penalties, allowable credits, and the total amount due.

- At the end of the form, ensure the ‘Signature of Taxpayer or Authorized Agent’ field is completed with the appropriate signature to certify the accuracy of the taxes filed.

- Save your changes and prepare to download or print the completed form. Review all entries for accuracy before submitting your return.

Compete your Sales And Use Tax Return electronically to simplify your tax filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.