Loading

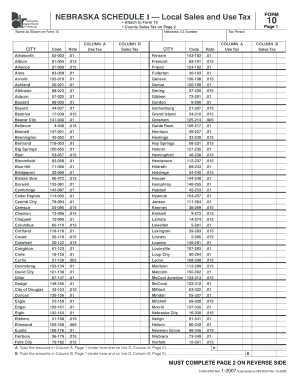

Get Nebraska Schedule I -- Local Sales And Use Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NEBRASKA SCHEDULE I -- Local Sales And Use Tax online

Filling out the Nebraska Schedule I for Local Sales and Use Tax online can be straightforward if you follow the right steps. This guide is designed to assist users through the process of completing the form accurately and efficiently.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as shown on Form 10 in the designated field. This ensures that your submission is properly linked to your tax return.

- Identify and select the appropriate city from the provided list. Each city has a unique code, which must be entered in the field.

- In the tax period section, specify the period for which the taxes are being filed. This is crucial for proper record-keeping.

- For Column A, use tax, enter the total amounts applicable from the transactions conducted during the specified period.

- In Column B, sales tax, record the amounts from sales activities for the same period. Be sure to use the correct rates corresponding to each city.

- After completing both columns, total the amounts in Column A and enter the result on line A at the bottom of Page 1.

- Total the amounts in Column B and enter the result on line B at the bottom of Page 1.

- Proceed to Page 2 and ensure that all required information is complete. This includes re-entering the totals from Page 1 and ensuring clarity.

- Once all fields are filled out correctly, save any changes made to the document. You may also download, print, or share the form as needed.

Complete your tax filing effortlessly by filling out the NEBRASKA SCHEDULE I online today.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.