Loading

Get 2 O0 2r 4 M

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2 O0 2R 4 M online

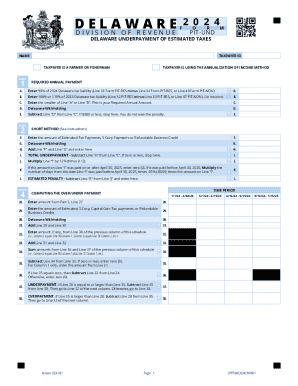

Filling out the 2 O0 2R 4 M online can seem daunting, but with this comprehensive guide, you can navigate each section with confidence. This document is essential for determining underpayment of estimated taxes in Delaware.

Follow the steps to complete the 2 O0 2R 4 M online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the taxpayer information, including the name and taxpayer ID. Ensure that all details are accurate and match your official records.

- In Part 1, provide the required annual payment calculations. Enter 90% of your 2024 Delaware tax liability, and then 100% or 110% of your 2023 tax liability. Determine the smaller of these two amounts for your required annual amount.

- Continue by listing Delaware withholding amounts and calculate the difference. If this amount is $800 or less, you do not owe a penalty and can proceed accordingly.

- Move to Part 2 and input any estimated tax payments, S Corporation payments, or refundable business credits. Then, sum these amounts with your Delaware withholding.

- Calculate your total underpayment by subtracting the sum from Part 1 from this new total. If this number is zero or less, you do not owe a penalty.

- In Part 4, compute any penalties based on the days elapsed since payment was due. Be sure to follow the guidelines provided for calculations.

- Review all sections for accuracy. Ensure that you've filled out each part completely and correctly, as errors may result in delays or additional penalties.

- Once you have verified all information, save your changes, and decide whether to download, print, or share the completed form.

Start completing your 2 O0 2R 4 M online to ensure timely processing and avoid penalties.

Related links form

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.