Loading

Get Recapture Of Idaho Small Employer

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RECAPTURE OF IDAHO SMALL EMPLOYER online

This guide provides clear and detailed instructions for users on how to fill out the RECAPTURE OF IDAHO SMALL EMPLOYER form online. Whether you have experience with tax documents or are navigating this process for the first time, this resource is designed to assist you in completing the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the RECAPTURE OF IDAHO SMALL EMPLOYER form and open it in your preferred document editor.

- Begin by entering the name(s) as shown on your return in the designated field.

- Provide your Social Security Number or Employer Identification Number (EIN) in the appropriate section.

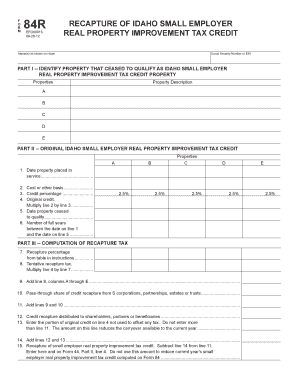

- Move to PART I – Identify property that ceased to qualify as Idaho small employer real property improvement tax credit property. Fill out lines A through E with descriptions of the properties.

- Document the date the property was placed in service on line 1 within PART II. This date is crucial for computing the tax credit.

- For line 2, input the cost or other basis of the property used when calculating the original Idaho small employer real property improvement tax credit.

- On line 8, calculate the tentative recapture tax by multiplying the amount from line 4 by the recapture percentage indicated on line 7.

- Add the results from line 8 in columns A through E and enter this total on line 9.

- If applicable, include any pass-through share of credit recapture from S corporations, partnerships, estates, or trusts on line 10.

- Add the totals from lines 9 and 10 to get the total credit subject to recapture and enter it on line 11.

- For line 13, remember to enter any unused portion of the original credit that was not used to offset any tax.

- Complete line 14 by adding lines 12 and 13.

- Finally, calculate the recapture of the small employer real property improvement tax credit. Subtract line 14 from line 11 and enter this amount accordingly.

- Once you have filled out all sections accurately, you can save the changes, download the completed form, print it for your records, or share it as needed.

Complete your RECAPTURE OF IDAHO SMALL EMPLOYER form online today!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.