Loading

Get Quarterly Estimated Tax/extension Of Time Payment

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the quarterly estimated tax/extension of time payment online

Completing the quarterly estimated tax or extension of time payment form is essential for managing your Idaho business income tax responsibilities. This guide will walk you through each step needed to successfully fill out this form online, ensuring you meet all requirements accurately and efficiently.

Follow the steps to fill out your form with ease.

- Click ‘Get Form’ button to access the form and open it in the editing interface.

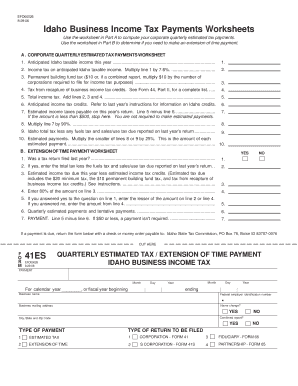

- Enter the anticipated Idaho taxable income for the year in section 1 of the corporate quarterly estimated tax payments worksheet.

- Calculate the income tax on anticipated taxable income by multiplying the figure from step 2 by 7.6%. Enter the result in section 2.

- If applicable, enter the permanent building fund tax in section 3. The amount is generally $10 or $10 multiplied by the number of corporations in a combined report.

- Record any tax resulting from the recapture of business income tax credits in section 4, referencing Form 44 for guidance.

- Sum the amounts from sections 2, 3, and 4 to determine total income tax. Place this total in section 5.

- Input any anticipated income tax credits from section 6, referencing last year's instructions for specific credits.

- Calculate the estimated income taxes payable on the current year’s return by subtracting section 6 from section 5. If this amount is less than $500, you do not need to make estimated payments.

- Multiply the amount from step 8 by 90% and place it in section 8.

- Refer to last year's return and enter the total tax less any fuels tax and sales/use tax in section 9.

- Determine the amount of your estimated payments by multiplying the smaller value of sections 8 or 9 by 25% and enter this in section 10.

- For the extension of time payment worksheet, begin by answering the question in section 1 regarding the filing of a prior year's tax return.

- If you answered 'yes' in section 1, enter the total tax, less any fuels tax and sales/use tax, from the previous year in section 2.

- Calculate the estimated income tax due for the current year including all applicable minimum taxes and credits in section 3.

- Enter 80% of the amount from section 3 in section 4.

- In section 5, enter the lesser of the amounts from section 2 or section 4 if you answered 'yes' to section 1, or just use the amount from section 4 if 'no'.

- List any previously made tentative payments in section 6.

- Calculate the payment due by subtracting section 6 from section 5. If this amount is $50 or less, a payment isn't required.

- Finally, review all entries for accuracy, save changes, and obtain options to download, print, or share the completed form.

Begin completing your Quarterly Estimated Tax or Extension of Time Payment form online today for a seamless filing experience.

One of the major cons of filing a tax extension is that while you get more time to file your tax return, your payment is still due by the April 15th deadline. If you owe taxes, missing the payment deadline will result in accumulating penalties and interest.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.