Loading

Get Tc49er041-2 Recapture Of Iqie Frm Prop Tax 7-28-04 V5. Tc49er041-2 Recapture Of Iqie Frm Prop Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TC49ER041-2 Recapture Of IQIE Frm Prop Tax 7-28-04 V5 online

This guide provides clear instructions on how to complete the TC49ER041-2 Recapture Of IQIE Frm Prop Tax 7-28-04 V5 form online. Designed for users with varying levels of legal experience, it aims to simplify the recapture process for property tax exemptions.

Follow the steps to effectively fill out the TC49ER041-2 Recapture Of IQIE Frm Prop Tax.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

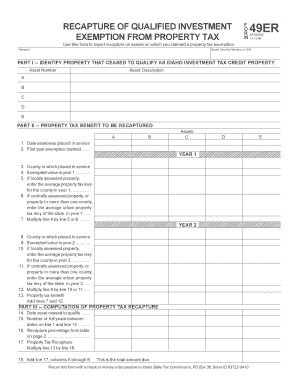

- In Part I, identify the properties that ceased to qualify for the Idaho Investment Tax Credit. Fill in the asset number and description for each item accurately.

- In Part II, for each asset, enter the date it was placed in service on line 1, followed by the year the exemption was first claimed on line 2.

- Indicate the county where the asset was placed in service on line 3. This should align with your previous documents.

- Provide the exempted value of the asset for the first year claimed on line 4. If unsure, consult the county assessor.

- For line 5, enter the average property tax levy for the county if the asset was locally assessed; otherwise, proceed to line 6.

- If the asset was centrally assessed, provide the average urban property tax levy of the state on line 6.

- If applicable, repeat steps 3 to 7 for the second year of exemption in the right column, skipping lines if not claimed.

- In Part III, enter the date the asset ceased to qualify on line 14 and the years between asset placement and cessation on line 15.

- Referencing the recapture percentage table, fill in the appropriate percentage on line 16.

- Calculate and enter the recapture amount by multiplying the total property tax benefit by the percentage on line 17.

- Finally, sum all calculations from line 17 and enter the total amount due on line 18.

- Return the completed form along with payment to the Idaho State Tax Commission as instructed.

Complete and submit your TC49ER041-2 Recapture Of IQIE Frm Prop Tax online today.

A federal law commonly known as "recapture tax" applies to borrowers who buy their homes using the Single Family Mortgage Bond Programs. Recapture tax requires some mortgagors to repay the government a portion of their gain upon sale of the home if they financed their home with a Mortgage Revenue Bond (MRB) loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.