Loading

Get Tc68041 Id Brdband Equip Inv Cred 6-07-04 Route4zap. Tc68041 Id Brdband Equip Inv Cred 6-07-04

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TC68041 Id Broadband Equip Inv Cred 6-07-04 online

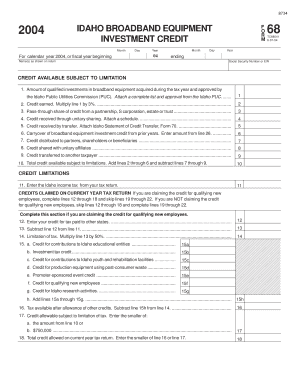

This guide provides a detailed, user-friendly overview of how to fill out the TC68041 Id Broadband Equipment Investment Credit form online. It outlines each section of the form and offers clear instructions to ensure that users can complete it accurately.

Follow the steps to successfully complete the TC68041 Id Broadband Equipment Investment Credit form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the calendar year or fiscal year for which you are filing. Include the month and day in the designated fields.

- Fill in the names as shown on your tax return in the corresponding section. Ensure that the names match exactly to avoid any discrepancies.

- Input the Social Security Number or Employer Identification Number in the provided field. This information is crucial for identifying your tax record.

- For line 1, report the amount of qualified broadband equipment investments acquired during the tax year. Make sure to attach a complete list of the equipment along with the approval from the Idaho Public Utilities Commission.

- Calculate the credit earned for line 2 by multiplying the amount from line 1 by 3%. Enter this figure in the appropriate space.

- If applicable, report any pass-through share of credit from partnerships or S corporations on line 3. Ensure to attach the corresponding schedule.

- For line 4, report any credit received through unitary sharing. Be sure to attach a schedule that details the amount received.

- If you have received credit through a transfer, enter the amount on line 5 and attach the Idaho Statement of Credit Transfer (Form 70).

- For line 6, complete lines 23 through 26 on page 2 and carry the amount from line 26 to this line.

- Fill in the appropriate sections for credit distribution on lines 7 and 8, specifying how the credit was shared or transferred.

- Calculate the total credit available by adding the amounts from lines 2 to 6 and subtracting the amounts from lines 7 to 9. Enter the total on line 10.

- Proceed to fill out the credit limitations section starting with line 11, where you enter your Idaho income tax from your tax return.

- Depending on whether you are claiming credits for qualifying new employees or not, follow the respective lines (12-18 or 19-22) as outlined in the instructions on the form.

- Complete evaluation of the credits available and any limitations on lines 17 and 18. Make sure to enter the smaller amount as required.

- After completing all lines and ensuring accuracy, you may save changes, download, print, or share the completed form as needed.

Complete your TC68041 Id Broadband Equipment Investment Credit application online today.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.