Loading

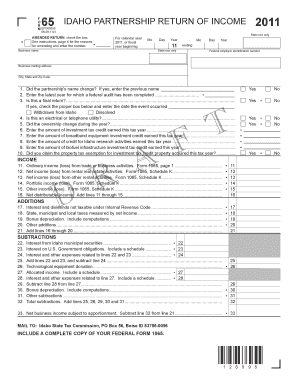

Get Did The Partnership's Name Change - Tax Idaho

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Did The Partnership's Name Change - Tax Idaho online

This guide provides clear, step-by-step instructions for completing the Did The Partnership's Name Change - Tax Idaho form. Designed for users of all experience levels, it will help ensure that your form is filled out accurately and efficiently.

Follow the steps to complete the form correctly.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Begin by entering the business name in the designated field. This is important for identification purposes.

- Indicate the year for which you are filing, whether it's the calendar year or a fiscal year starting and ending on specified dates.

- If the partnership’s name has changed, check the box provided and enter the previous name in the space provided.

- Input the federal employer identification number (EIN) to adequately identify the partnership.

- Complete the business mailing address, including the city, state, and zip code.

- Answer the question regarding whether this is a final return by checking the appropriate box and entering the relevant event date if applicable.

- Provide details about ownership changes, investment tax credits, and other specific queries outlined in the form.

- Carefully report your partnership's income details, including ordinary income or loss and any additions or subtractions to income.

- Review all entries to ensure accuracy and completeness.

- Once all information is confirmed, save changes, download the form, and prepare to submit it as per the provided instructions.

Complete your documents online today to streamline your submission process.

Changes to Idaho's tax rate Idaho's tax rate is now 5.695% for all taxpayers. For individuals, the rate applies to taxable income over: $2,500 if you're filing single. $5,000 if you're filing jointly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.