Loading

Get Irs 13206 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 13206 online

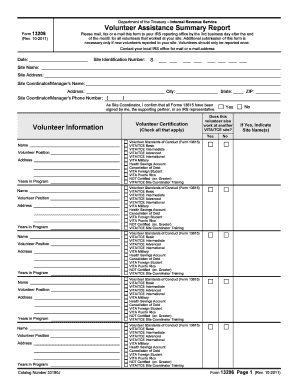

Filling out the IRS Form 13206, known as the Volunteer Assistance Summary Report, is essential for reporting the volunteers who contributed at your site. This guide provides clear instructions to help you complete the form online efficiently and accurately.

Follow the steps to effectively fill out the IRS 13206 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the date in the designated field at the top of the form. This should reflect the reporting date of your submission.

- Provide the Site Identification Number. This number is essential for IRS record-keeping, so ensure it is accurate.

- Fill in the Site Name and Site Address. This information identifies where the volunteers operated.

- Complete the Site Coordinator/Manager’s Name and Address section. This identifies the person responsible for overseeing the volunteers.

- Input the Site Coordinator/Manager’s Phone Number, ensuring you include the area code.

- As the Site Coordinator, affirm that all Forms 13615 have been signed by you or an authorized individual by checking the confirmation box.

- Begin entering Volunteer Information. For each volunteer, include their Name, Position, Address, and Years in the Program, ensuring all fields are filled out accurately.

- For each volunteer, indicate if they also work at another VITA/TCE site by checking the appropriate box and providing the Site Name if applicable.

- Select the appropriate Volunteer Standards of Conduct by checking the boxes for the certifications that apply to each volunteer.

- Once you have completed the volunteer information, review the totals generated at the end of the form. Make sure to document the total number of volunteers reported, previously reported, and those reported this filing season.

- After completing all sections, you can save your changes, download the form for your records, print a physical copy, or share the form as required.

Complete your IRS Form 13206 online today to ensure your volunteer information is accurately reported.

The IRS would send you a bill after they processed your tax return if the payment did not get made for some reason. You can pay the tax online or with a check, but it may get debited again if you do that. If that happened, the IRS would probably refund the extra payment, but no right away necessarily.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.