Loading

Get Irs 1040 Schedule R 1995-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Schedule R online

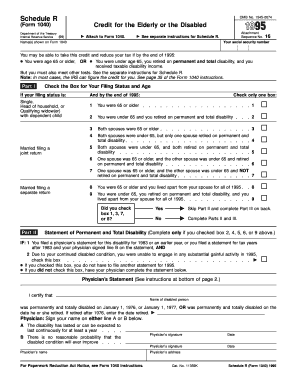

Filling out the IRS 1040 Schedule R can help individuals claim a credit for the elderly or disabled, potentially reducing their tax burden. This guide provides a straightforward approach to completing the form online, ensuring users can effectively navigate each component of the document.

Follow the steps to successfully complete Schedule R online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the names as shown on Form 1040 in the designated field at the top of Schedule R.

- Input your social security number in the appropriate space provided.

- In Part I, check the box that accurately reflects your filing status and age at the end of 1995. Ensure you are aware of the eligibility criteria concerning age and disability.

- If applicable, answer the question in Part II regarding the completion of a physician's statement for permanent and total disability.

- If you checked certain boxes in Part I that require a physician's statement, complete the physician's certification section, including the physician's signature and date.

- Proceed to Part III to determine your credit by entering relevant amounts based on your filing status and income situation as outlined on the form.

- Ensure that you verify all entries before finalizing your information, including checking calculations for lines 10, 11, and beyond.

- Once completed, users can save changes, download a copy for their records, print the form, or share it as needed.

Start completing your IRS 1040 Schedule R online today and make sure to maximize your credits!

Tax forms 1040 and 1040-SR are nearly identical. The main advantage of using Form 1040-SR is that it has a larger type, making it easier to read if you're doing your taxes by hand. It also emphasizes some specific tax benefits for those over age 65, although these benefits are also included in Form 1040.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.