Loading

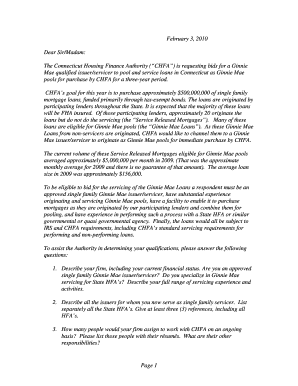

Get Mae Qualified Issuer/servicer To Pool And Service Loans In Connecticut As Ginnie Mae - Chfa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mae Qualified Issuer/servicer To Pool And Service Loans In Connecticut As Ginnie Mae - Chfa online

This guide provides a detailed, step-by-step approach to filling out the Mae Qualified Issuer/servicer To Pool And Service Loans In Connecticut As Ginnie Mae - Chfa form online. It is designed to assist users at all experience levels in navigating the application process efficiently and effectively.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to download the form and open it in your browser or PDF viewer.

- Review the instructions carefully to ensure all required information is understood. Make sure to gather necessary documentation to support your application.

- Begin filling in your firm’s name and contact details at the top of the form. Ensure accuracy as this is crucial for identifying your submission.

- Provide a detailed description of your firm, including your financial status and approval as a Ginnie Mae issuer/servicer. Highlight relevant experience and capabilities.

- List the other issuers as a single family servicer and provide references. Aim to include at least three reputable contacts to enhance credibility.

- Detail the number of personnel who will work with the Connecticut Housing Finance Authority (CHFA) and include résumés for those individuals.

- Describe your experience dealing with mortgages funded through tax-exempt bonds, as well as your reporting capabilities.

- Submit information on your firm's commitment to affirmative action, including hiring practices and relationships with diverse businesses.

- Outline the envisioned process for working with CHFA, demonstrating your understanding of the workflow and communication methods.

- Disclose any past removals from accounts and any potential compliance issues that have arisen.

- Respond to the statutory provisions, affidavits, and certifications section by executing all required documents accurately.

- Indicate your presence in Connecticut, providing details about offices, employees, and any civic engagements.

- State your bid as a percentage of the principal amount of each loan, detailing any conditions associated with your offer.

- After completing the form, review everything for accuracy and clarity. Save your changes and prepare for submission.

- Submit six copies of the completed bid form along with qualifications to CHFA by the specified deadline.

Take action now and complete your form online to become a qualified issuer/servicer!

Freddie Mac does not make loans directly to homebuyers. The primary business of Freddie Mac is to purchase loans from lenders to replenish their supply of funds so they can make more mortgage loans to other bor- rowers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.