Loading

Get Flc 14 Instructions: Complete This Form In Duplicate And Return Them ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FLC 14 Instructions: Complete This Form In Duplicate And Return Them online

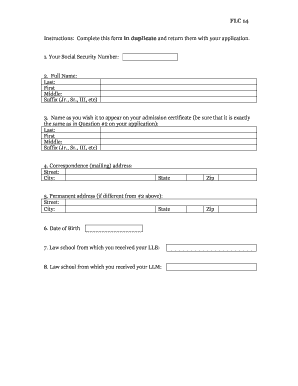

Filling out the FLC 14 form is an important step in your application process. This guide provides a clear and concise overview of how to accurately complete the form online, ensuring that you provide all necessary information.

Follow the steps to successfully complete the FLC 14 form online.

- Click the ‘Get Form’ button to access the form. This will allow you to download or view the FLC 14 in your preferred format.

- Enter your Social Security Number in the designated field. Make sure this information is accurate as it is critical for your application.

- Provide your full name in the appropriate fields. Include your last name, first name, middle name, and any suffixes such as Jr., Sr., III, etc.

- Fill out the name as you wish it to appear on your admission certificate. This should match precisely with the full name provided in step 3.

- Input your correspondence (mailing) address. Include your street address, city, state, and zip code to ensure accurate mailing.

- If your permanent address differs from your mailing address, provide that information in the next section, including street, city, state, and zip code.

- Indicate your date of birth in the specified format to avoid any confusion.

- List the law school from which you received your LLB degree, including the full name of the institution.

- Finally, note the law school from which you received your LLM degree, ensuring correct institutional information.

- Once all fields are satisfactorily filled, save your changes, and choose to download, print, or share your completed form as necessary.

Complete your FLC 14 form online today to streamline your application process.

If both returns were the same and the IRS already accepted the e-filed return, the IRS will reject the return that you mailed. However, the rejected return might delay the time it takes the IRS to process your return. It also might take longer to receive your refund if you are owed one. Was this topic helpful?

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.