Loading

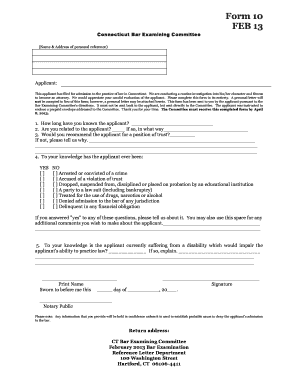

Get Instructions For Forms 10 And 11, Form 10 Feb 13

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Instructions For Forms 10 And 11, Form 10 Feb 13 online

This guide provides a clear and comprehensive approach to filling out the Instructions For Forms 10 And 11, Form 10 dated February 13 online. Follow these steps to ensure that you complete the forms accurately and efficiently.

Follow the steps to complete your forms online successfully.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- For Form 10, begin by typing your name on the 'Applicant:' line. Next, include the name and address of your personal reference in the designated box at the top left. It's important not to fill out the rest of the form.

- Mail the completed Form 10 to the personal reference using a stamped envelope addressed to the specified address. Remember, you cannot use a supervisor listed on Form 5 as a personal reference, and personal references cannot be related to one another.

- If a personal reference does not respond, you may replace them. Notify the office in writing about the name of the new reference.

- For Form 11, start by typing your name on the 'Applicant:' line as it appears on your bar application in Question #2. Fill in your name during employment if it differs from the above, along with your social security number.

- Next, provide details about your position, dates of employment, and the name and address of the employer in the upper left box. Similar to Form 10, do not fill out the remaining sections of the form.

- Mail the Form 11 to your employer using a stamped envelope addressed to the Committee. Be sure to include a cover letter highlighting the importance of returning the form promptly and authorizing the release of your employment information.

- Note that it is not necessary to submit Form 11 for military service, self-employment, or certain unpaid employment. Do not list these types of employment in your Form 5.

- If an employer is out of business, make an effort to find their employment records and send Form 11 there. If Form 11 is returned undelivered, send it to the office with an explanation of your efforts.

- Lastly, each time you send a Form 11, consider using certified mail with a return receipt requested to prove submission. You must list each employer that requires a Form 11 on the back of Form 5.

- After completing all sections, save your changes to the form, and choose to download, print, or share it as needed.

Start filling out your forms online today to ensure a smooth application process.

Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.