Loading

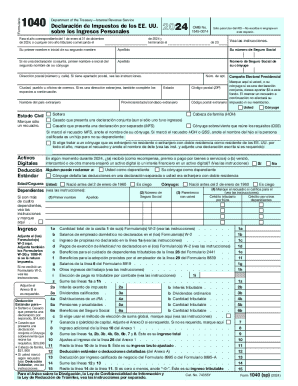

Get Irs 1040 (sp) 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 (SP) online

This guide provides a clear and supportive approach to filling out the IRS 1040 (SP) form online for your personal income tax return. With detailed, step-by-step instructions, you can navigate the process with confidence.

Follow the steps to effectively complete your IRS 1040 (SP) online.

- Press the ‘Get Form’ button to obtain the IRS 1040 (SP) form and open it in your document editor.

- Begin by entering your name, followed by your middle initial (if applicable), and your last name in the designated fields. Make sure to provide your Social Security number accurately.

- If you are filing jointly, repeat the process for your spouse by entering their first name, middle initial, last name, and Social Security number in the corresponding fields.

- Next, fill in your mailing address, ensuring to include the street number, street name, apartment number (if applicable), city, state, and ZIP code. If you reside outside the United States, complete the foreign address fields as necessary.

- Select your filing status by marking the appropriate box. Options include 'Single,' 'Head of household,' 'Married filing jointly,' 'Married filing separately,' or 'Qualifying surviving spouse.' Only select one.

- If applicable, provide information regarding dependents by listing their names, Social Security numbers, and relationships to you.

- Proceed to the income section by entering your total wages, salaries, tips, and any other income from your W-2 forms and other statements, following the line numbers as per the instructions.

- Calculate your adjusted gross income by making applicable deductions from your total income, following the guidance outlined in the instructions attached to the form.

- Fill out the tax liabilities and applicable credits sections based on your calculations, ensuring accuracy with respect to any details from your previous returns.

- Review your entries for accuracy and completeness before signing the form. Indicate if you would like your refund deposited directly into your bank account by providing the necessary bank details.

- Finally, save your changes. You can download, print, or share the completed form as required before submission.

Complete your IRS 1040 (SP) form online today for a hassle-free filing experience.

Extra tax deductions for seniors If you don't itemize your deductions, you can get an extra standard deduction if you and/or your spouse are 65 years old or older. These are $1,950 for single filers and $1,550 for married individuals filing jointly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.