Loading

Get Request For Copy Of Corporation, Exempt Organization,

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the REQUEST FOR COPY OF CORPORATION, EXEMPT ORGANIZATION, online

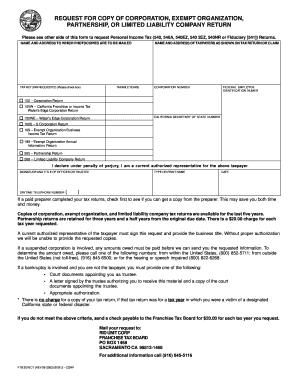

Filling out the request for a copy of a corporation, exempt organization, partnership, or limited liability company return can seem daunting. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully request your tax document

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the name and address to which photocopies are to be mailed. Ensure that the address is complete and clearly written to avoid any delays in processing.

- Provide the name and address of the taxpayers as shown on the tax return or claim. This information must match exactly with the records to ensure the request is valid.

- Indicate the tax return requested by checking the appropriate box. Choices include various types of returns, such as Corporation Return, Exempt Organization Business Income Tax Return, Partnership Return, etc.

- Fill in the corporation number, if applicable, as well as the Federal Employer Identification Number to assist in identifying the correct tax records.

- Specify the taxable years for which you are requesting copies. Include the relevant years to avoid confusion.

- Sign the form, and include the title of the officer or trustee. This must be the signature of a current authorized representative to ensure the request is legitimate.

- Provide a daytime telephone number where you can be reached for any follow-up inquiries about your request.

- Type or print your name and date the request. Ensure this is done clearly.

- If applicable, review the conditions mentioned at the bottom of the form regarding charges and exemptions. Prepare any payment if necessary and send your complete request to the address provided.

- After filling out the form, save your changes. You may then choose to download, print, or share the form as needed.

Take action now to request your documents online and get the help you need.

For a group that filed its Form 1023 after July 15, 1987, and cannot find its copy, contact the IRS Customer Service at (877) 829-5500 to get a replacement copy. Or, mail your request to IRS, TE/GE Customer Account Services at PO Box 2508, Cincinnati, OH 45201. IRS tax information for nonprofits can be found here.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.