Loading

Get 2009 Instructions For Schedule P (540nr) -- Alternative Minimum Tax And Credit Limitations

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2009 instructions for Schedule P (540NR) -- Alternative Minimum Tax and Credit Limitations online

Filling out the 2009 Instructions for Schedule P (540NR) can be straightforward when you follow a structured approach. This guide will provide you with comprehensive, step-by-step instructions to successfully complete the form online.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred digital editor.

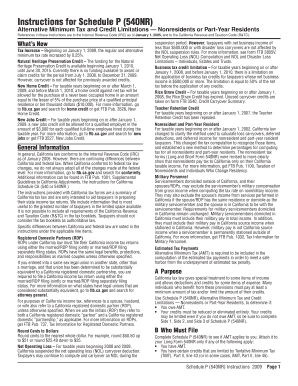

- Begin with the introductory section and ensure you understand the purpose of the Schedule P (540NR). This form is used to determine if you owe Alternative Minimum Tax (AMT) and to identify any credit limitations.

- Move to Part I to calculate your Alternative Minimum Taxable Income (AMTI). Carefully enter adjustments and preferences on the relevant lines, ensuring to cross-reference with your Long Form 540NR.

- In Part II, complete calculations for AMT. This includes determining your exemption amount and ensuring adjustments are correctly recorded according to your tax situation.

- Once Part II is complete, move to Part III to identify any available credits that reduce your tax. Be sure to follow the provided instructions to ensure accurate credit allocation.

- Review your entries thoroughly for any discrepancies or omissions. Make sure all calculations are accurate and supported by the necessary documentation.

Get started on completing your documents online today!

Under the tax law, certain tax benefits can significantly reduce a taxpayer's regular tax amount. The alternative minimum tax (AMT) applies to taxpayers with high economic income by setting a limit on those benefits. It helps to ensure that those taxpayers pay at least a minimum amount of tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.