Loading

Get Taxable Year 2009 Sales Of Businessrecapture Amounts Under Irc Sections 179 And 280f And Property

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TAXABLE YEAR 2009 Sales Of Businessrecapture Amounts Under IRC Sections 179 And 280F And Property online

This guide provides a comprehensive overview of how to accurately complete the TAXABLE YEAR 2009 Sales Of Businessrecapture Amounts Under IRC Sections 179 And 280F And Property form. By following these steps, users can ensure their filings are correct and compliant with regulations.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to access the document and open it in a suitable editor.

- Begin by entering your name(s) as shown on your tax return in the designated field at the beginning of the form.

- Next, provide your Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or other identification numbers in the field specified.

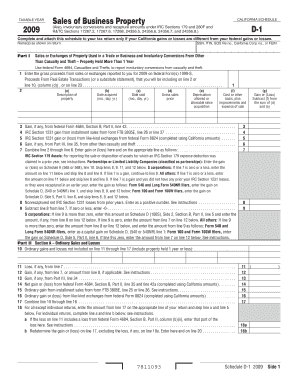

- Proceed to Part I, where you will list the sales or exchanges of property. Enter the gross proceeds from any sales you reported on federal Form 1099-S, ensuring to include all required details.

- Fill out the columns provided, detailing the description of the property, date acquired, date sold, gross sales price, depreciation allowed, and cost or other basis, including improvements.

- Calculate any gains or losses by following the instructions and complete the calculations as specified on the form. Ensure that each line is filled out accurately.

- Continue to Part II and report any ordinary gains and losses as instructed. This section includes details about any prior net losses and adjustments required.

- In Part III, complete the details regarding any dispositions of property under the specified IRC sections, ensuring to provide the gross sales price, cost basis, depreciation, and adjusted basis.

- Finally, review all filled sections for accuracy. Users should save their changes, download the completed form, print a copy for their records, or share it as needed.

Complete your documents online to ensure a smooth filing process.

How to report a section 179 expense recapture Under Input Return, select Income. Select Disposition (Sch D, etc.), then Schedule D/4797/etc. Select Carryovers/Misc Info. Select the 4797 Carryovers & Recap tab. Under the Form 4797 section, scroll to the Recapture 50% or Less Business Use subsection.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.