Loading

Get Ssn, Itin, Ca Sos File No

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SSN, ITIN, CA SOS File No online

Filling out the SSN, ITIN, and CA SOS File No can be a straightforward process when you have the right guidance. This guide will walk you through each section, ensuring you understand what is required for successful completion.

Follow the steps to complete your form accurately and efficiently.

- Click ‘Get Form’ button to access the necessary form and open it in your preferred editor.

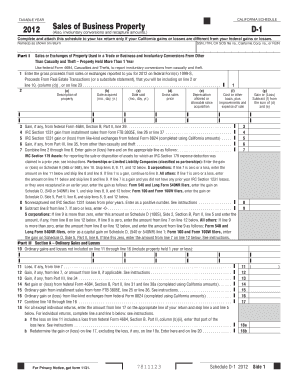

- Begin by locating the section for the sales or exchanges of property used in a trade or business. You will need to enter the gross proceeds from sales reported to you, as indicated on federal Form 1099-S.

- Enter the date the property was acquired in the specified format (month, day, year).

- Provide a description of the property being sold.

- Next, input the date the property was sold, again using the month, day, year format.

- Enter the gross sales price received from the sale of the property.

- Determine and record the depreciation allowed or allowable since acquisition.

- Calculate the cost or other basis, including improvements and the expense of the sale, and enter this information.

- If applicable, enter nonrecaptured net IRC Section 1231 losses from prior years as a positive number.

- After filling out all relevant fields, review your entries for accuracy. Finally, you can save changes, download the completed form, print it, or share it as needed.

Complete your documents online with confidence today!

Any inquiry regarding an ITIN application status should be directed to the IRS toll-free at 1-800-829-1040 or 1-800-908-9982 (select option 1 for English, then option 2 to check ITIN application status).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.