Loading

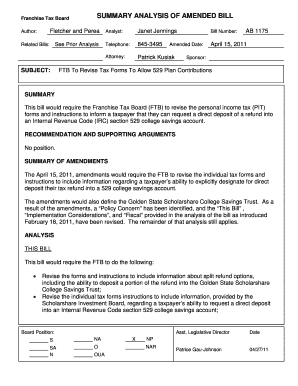

Get Ftb To Revise Tax Forms To Allow 529 Plan Contributions - Ftb.ca.gov - Ftb Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FTB To Revise Tax Forms To Allow 529 Plan Contributions online

Filling out the FTB To Revise Tax Forms To Allow 529 Plan Contributions can be an important step for individuals looking to allocate their tax refunds towards a 529 college savings account. This guide provides comprehensive instructions to assist users in effectively completing the form online.

Follow the steps to successfully fill out the form.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Review the personal information section carefully. Enter your full name, address, and social security number as required. Ensure that this information matches your official documents.

- Navigate to the section for designated deposits. Here, you will find options to specify how you wish to divide your tax refund, including the option to direct part of it into a 529 college savings account.

- Locate the field specifically labeled for direct deposit into a 529 college savings account. Clearly input the routing number of the financial institution and your account number for the 529 plan.

- Double-check all the information you have entered for accuracy. Mistakes in routing or account numbers can delay your refund.

- Once you have completed the form, you can save your changes, download a copy for your records, print the form, or share it as needed.

Complete your forms online today to ensure your tax refund contributions support your college savings goals.

California does tax S Corps Also, all LLCs and S Corps must pay a minimum franchise tax of $800 annually, except for the first year. Your business will be required to pay these taxes in advance four times per year in the form of estimated corporate taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.