Loading

Get Taxable Year 2008 California Schedule G-1 Tax On Lump-sum Distributions Attach To Form 540, Long

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TAXABLE YEAR 2008 CALIFORNIA SCHEDULE G-1 Tax On Lump-Sum Distributions Attach To Form 540, Long online

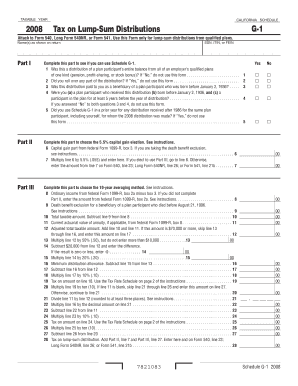

The TAXABLE YEAR 2008 CALIFORNIA SCHEDULE G-1 is essential for individuals receiving lump-sum distributions from qualified retirement plans. This guide provides step-by-step instructions on how to complete the form accurately and efficiently.

Follow the steps to fill out your Schedule G-1 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify if you can use Schedule G-1 by answering the questions in Part I. You must confirm that you had a distribution of an entire balance from all qualified plans, and that you have not rolled over any part of the distribution.

- Complete Part II if you choose to make the 5.5% capital gain election. Enter the capital gain amount from your federal Form 1099-R, box 3, if applicable.

- Proceed to calculate your tax on the lump-sum distribution using Line 7, where you multiply the line 6 amount by 5.5% if applicable.

- If utilizing the 10-year averaging method, complete Part III by entering the ordinary income amount from federal Form 1099-R, box 2a minus box 3 on line 8.

- Calculate any death benefit exclusion you qualify for on line 9. Enter the total taxable amount on line 10.

- Complete lines 11 through 28 as necessary to arrive at the total tax amount, ensuring you apply any relevant tax rate schedules appropriately.

- Once completed, save changes, download, print, or share the form as required.

Start filling out your TAXABLE YEAR 2008 CALIFORNIA SCHEDULE G-1 online today to ensure accurate filing.

Schedule CA 540 should be attached to your Form 540 if you need to make any adjustments to your income because of differences between California and federal tax laws. It's used to modify federal adjusted gross income and itemized deductions to align with California's tax rules. Can I file CA 540 online?

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.