Loading

Get Irs Information And Forms - 2025 Tax Forms, Instructions ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Information And Forms - 2025 Tax Forms, Instructions online

Completing the IRS information and forms online can simplify your tax preparation process. This guide provides step-by-step instructions to help you accurately fill out the 2025 tax forms and instructions.

Follow the steps to seamlessly fill out your tax forms online.

- Click the 'Get Form' button to access the 2025 tax forms and open them in your digital editor.

- Review the document structure. It typically includes a cover page followed by specific forms and schedules based on your tax situation.

- Complete personal information fields, ensuring accuracy in your name, address, and Social Security number.

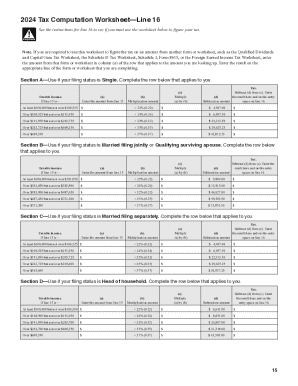

- Follow the prompts for income reporting, including wages, interest, dividends, and other sources of income. Use the tax tables to assist in calculating the correct amounts.

- Fill out sections related to deductions and credits, such as the Earned Income Credit and any other applicable deductions.

- Carefully review all filled sections for any errors or omissions before finalizing. Adjust any calculations if necessary.

- Once all fields are complete, save your document. You can then choose to download, print, or share the form with your tax professional or submit it directly to the IRS.

Start filling out your tax documents online today!

For single filers and heads of households age 65 and over, the additional standard deduction will increase slightly — from $1,950 in 2024 (returns you'll file soon in early 2025) to $2,000 in 2025 (returns you'll file in early 2026).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.