Loading

Get Irs 8867 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8867 online

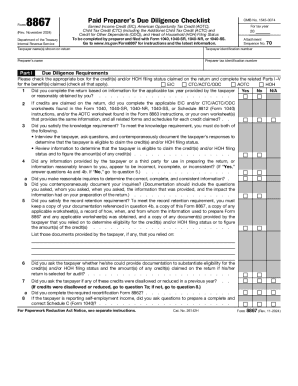

The IRS 8867 form, also known as the Paid Preparer’s Due Diligence Checklist, is essential for paid preparers claiming certain tax credits on behalf of their clients. This guide will provide clear and detailed instructions on completing the IRS 8867 online to ensure compliance and accuracy.

Follow the steps to complete the IRS 8867 form online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by completing the taxpayer's name and identification number. Ensure the correct identification number is entered accurately to avoid delays.

- Next, fill in the preparer’s name and tax identification number. This information is crucial for identifying the individual responsible for the tax return.

- Proceed to Part I to check the appropriate boxes for the credits and/or Head of Household (HOH) filing status claimed on the return. This informs the IRS which benefits are being applied for.

- Answer the due diligence questions as prompted in Part I. Make sure to document the taxpayer’s eligibility based on the information you have gathered.

- For Part II, focus on the due diligence questions specific to claiming Earned Income Credit (EIC). Detail any discussions you observed regarding the taxpayer's dependents.

- Complete Part III if claiming Child Tax Credit (CTC), Additional Child Tax Credit (ACTC), or Credit for Other Dependents (ODC). Ensure that you verify the eligibility of dependents claimed.

- Continue through Part IV for additional due diligence questions specific to HOH claims and other applicable credits. Accurately document your findings.

- In Part V, review any required supporting documentation for the American Opportunity Tax Credit (AOTC), ensuring that all necessary evidence has been collected.

- Finally, in Part VI, certify that you have adequately completed Form 8867 by marking the appropriate boxes. Ensure that all answers are truthful and complete.

- Once all sections have been filled out correctly, save your changes. You may then download, print, or share the completed form as required.

Complete your IRS 8867 form online today to ensure accurate and reliable submissions.

Related links form

The maximum penalty imposed on any tax return preparer shall not exceed $25,000 in a calendar year. Providing False Information – Fraud and false statements are considered felonies under IRS rules. The penalties can reach up to $100,000 for individual returns and up to $500,000 for corporate returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.