Loading

Get Irs 5471 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5471 online

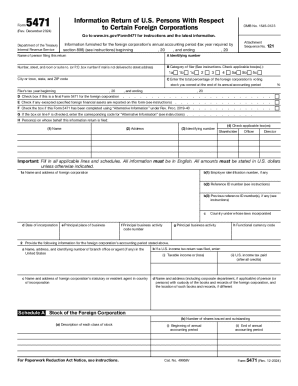

This guide provides a detailed overview of filling out the IRS Form 5471, which is required for U.S. persons with interests in foreign corporations. Follow the instructions carefully to ensure accurate completion of each section of the form.

Follow the steps to fill out the IRS 5471 online:

- Press the ‘Get Form’ button to obtain the form and open it in your document editor.

- Begin by providing your basic information including your name, identifying number, address, and the tax year for the foreign corporation.

- In section B, select your category of filer by checking the applicable box. Make sure to review the instructions to determine which category applies to you.

- Specify the total percentage of the foreign corporation’s voting stock you owned at the end of its annual accounting period.

- If applicable, check the box indicating if this Form 5471 has been completed using 'Alternative Information' and enter the corresponding code if necessary.

- Provide details regarding the foreign corporation, including its name, address, employer identification number, and date of incorporation in section 1a to 1g.

- Complete section 2 by providing the necessary information regarding the foreign corporation's accounting period.

- Fill out Schedule A by detailing the stock of the foreign corporation, including number of shares and class of stock.

- In Schedule B, list the shareholders of the foreign corporation, including pertinent details like the description of stock and shares held.

- Proceed to Schedule C, where you will report the income statement, and ensure all amounts are stated in U.S. dollars.

- Complete Schedule F with the balance sheet information, ensuring that all amounts align with U.S. GAAP.

- Answer questions in Schedule G regarding any significant transactions or relationships with the foreign corporation.

- Once all sections and schedules are completed, you can save your changes, download the form, or print it for your records.

Complete your IRS Form 5471 online today to ensure compliance and avoid penalties.

Exemption from foreign tax credit limitation (suppress Form 1116) All foreign gross income is passive. A qualified payee statement reports the income and foreign taxes. The total creditable foreign taxes are not more than $300 ($600 for married filing jointly).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.