Loading

Get Na 271.pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NA 271.pdf online

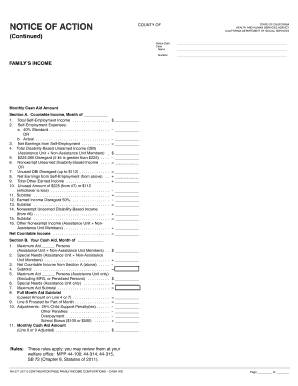

The NA 271.pdf form is essential for assessing a family's income for cash aid in California. This comprehensive guide will provide you with clear instructions on how to complete the form online, ensuring accuracy and completeness.

Follow the steps to successfully fill out the NA 271.pdf online.

- Click ‘Get Form’ button to access the NA 271.pdf form in your preferred online editor.

- Begin by entering the notice date on the form, ensuring it reflects the date you are completing the application.

- In the 'Name' field, clearly write the name of the person designated as the primary applicant for the cash aid.

- Fill out the 'Case Number' section, entering the assigned case number relevant to the applicant.

- In Section A titled 'Family’s Income', provide the total self-employment income for the specified month.

- Indicate the self-employment expenses by choosing either the 40% standard deduction or the actual expenses incurred.

- Calculate and enter the net earnings from self-employment by subtracting the self-employment expenses from the total self-employment income.

- Record the total disability-based unearned income, including contributions from both assistance unit and non-assistance unit members.

- If applicable, enter the $225 DBI disregard if the total disability-based income exceeds $225.

- List any nonexempt unearned disability-based income and any unused DBI disregard (up to $112) if applicable.

- Provide the total other earned income from all sources.

- Calculate the subtotal by adding all the relevant income figures from the previous entries.

- Apply the earned income disregard of 50% and record this calculation.

- Input the nonexempt unearned disability-based income amounts to arrive at the updated subtotal.

- Summarize other nonexempt income contributions from all household members.

- Determine your net countable income by adding or subtracting the relevant figures from this section.

- Proceed to Section B and input the maximum aid for the assistance unit, as well as any special needs identified.

- Input your net countable income from Section A into this section for aid calculations.

- Provide the maximum aid figures specific to the assistance unit without including special categories.

- Calculate and note any adjustments such as penalties or school bonuses that may affect your monthly cash aid amount.

- Finally, review all entries carefully before saving changes, downloading, printing, or sharing the form.

Complete your forms online today for a smoother filing process!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.