Loading

Get 2024 I-119 Instructions For Wisconsin Schedule T

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2024 I-119 Instructions For Wisconsin Schedule T online

Filling out the 2024 I-119 Instructions For Wisconsin Schedule T online can seem challenging, but this comprehensive guide will walk you through the process step by step. By following these clear instructions, you will ensure that all necessary information is correctly entered, aiding in a smooth filing experience.

Follow the steps to complete your Schedule T accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

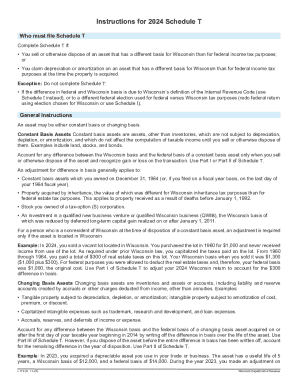

- Review the form to determine if you must file Schedule T. You are required to complete Schedule T if you sell or dispose of an asset with a different basis for Wisconsin compared to federal income tax, or if you claim depreciation or amortization on such an asset.

- Fill in Part I for adjustments on capital assets sold in 2024 that have differing bases. First, identify the holding period for each capital asset. For assets held one year or less, complete line 1a, determining the Wisconsin and federal adjusted bases to identify any differences.

- For capital assets held longer than one year, provide information on line 2a similarly, calculating any adjustments in column C to capture the difference in bases.

- Complete Part II if any sales or other dispositions were reported on federal Form 4797, ensuring the inclusion of relevant asset descriptions and their adjusted bases.

- Proceed to Part III if you are dealing with changing basis assets acquired after the first day of your taxable year beginning in 2014. Document any adjustments required over the life of the asset for proper reflection in your financial records.

- Once all sections are filled out correctly, save your changes, and then download or print the completed form for your records. You may also share it as needed.

Take the first step towards completing your filing by accessing the form online today.

Recent tax rate changes in Wisconsin Starting January 1, 2024, both Milwaukee County and the City of Milwaukee will increase its sales taxes. Sales taxes in the City of Milwaukee will rise from 5.5% to 7.9%, while sales taxes outside the city, but still within Milwaukee County, will rise from 5.5% to 5.9%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.