Loading

Get Non-scannable Forms Form Revision And Release Dates

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NON-SCANNABLE FORMS Form Revision And Release Dates online

Completing the NON-SCANNABLE FORMS Form Revision And Release Dates online is a straightforward process that requires attention to detail. This guide aims to support users in accurately filling out each section of the form, ensuring compliance and successful submission.

Follow the steps to complete the form efficiently.

- Click the ‘Get Form’ button to obtain the form and access it in the editor.

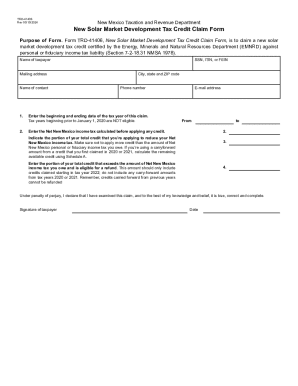

- Fill in the name of the taxpayer in the designated field. This should be the individual or entity claiming the credit.

- Provide the mailing address, including city, state, and ZIP code. Ensure that this information is complete and accurate.

- Enter the Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Federal Employer Identification Number (FEIN) as applicable.

- Input the contact person's name and phone number for any queries related to the form.

- Specify the email address for electronic communication regarding the form and its processing.

- Indicate the beginning and ending dates of the tax year for which this claim is being made. Note that tax years starting before January 1, 2020, are not eligible.

- Fill in the amount of Net New Mexico income tax calculated prior to applying any credits.

- Indicate the portion of the total credit being applied to reduce the Net New Mexico income tax. Ensure not to exceed the tax owed.

- Enter the portion of the total credit that exceeds the amount of Net New Mexico income tax owed and that is eligible for a refund, applicable only for credits claimed starting in tax year 2022.

- Review the declaration under penalty of perjury section. Ensure you confirm the accuracy of the claim before proceeding.

- Sign and date the form to confirm that all information provided is true and complete.

- After completing the form, users can save changes, download the completed form, print it, or share it as needed.

Start completing your documents online now for a seamless experience.

Individual returns Electronically filed Form 1040 returns are generally processed within 21 days. We're currently processing paper returns received during the months below.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.