Loading

Get Irs Lt11c 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS LT11C online

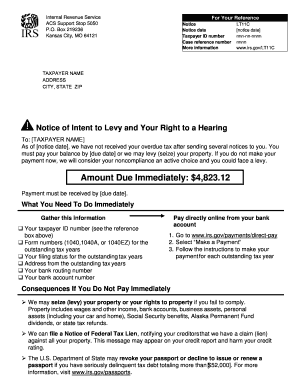

Filling out the IRS LT11C form is a critical step in addressing your overdue tax situation. This guide provides user-friendly instructions to assist you in completing the form accurately and efficiently, ensuring you maintain compliance and avoid potential levies.

Follow the steps to fill out the IRS LT11C form online with ease.

- Click the ‘Get Form’ button to access the LT11C form and open it in the editor.

- Fill in your taxpayer name at the top of the form, ensuring it matches the name associated with your tax records.

- Enter your address, ensuring all details are correct and in line with the address on file for your tax account.

- Complete the notice date field by entering the date indicated on the notice you received.

- Provide your taxpayer ID number in the designated area, which is crucial for identifying your tax account.

- Review the billing summary section for accuracy regarding the tax periods and amounts due.

- If applicable, include any additional information required for your specific scenario, such as filing status or payment arrangements.

- After confirming all information is accurate and complete, save your changes. You can then download, print, or share the completed form as needed.

Take action now by filling out the IRS LT11C form online to address your tax obligations promptly.

Related links form

In a CDP hearing, the taxpayer can: Request an alternative collection method, such as a tax payment plan. Raise an Innocent Spouse Defense. Argue for abatement of interest and penalties. Challenge the underlying tax debt (in some circumstances) Argue against the filing of tax lien,

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.