Loading

Get Form 900-xm Application For Five-year Ad Valorem Tax Exemption ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 900-XM Application For Five-Year Ad Valorem Tax Exemption online

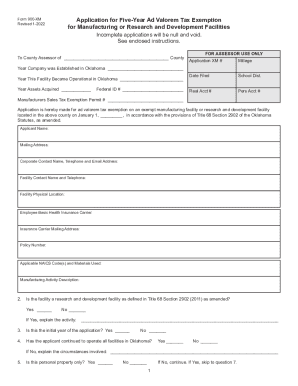

Filling out the Form 900-XM Application For Five-Year Ad Valorem Tax Exemption is essential for entities seeking tax exemptions for manufacturing or research and development facilities in Oklahoma. This guide provides a clear and detailed approach to assist users with varying levels of experience in completing the application online.

Follow the steps to complete your application accurately.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- At the top of the form, enter the year in which each asset group was acquired in the specified section labeled 'Assets Acquired ______.'

- In the first paragraph, fill out the tax year for which you are filing the application by entering the year in the blank marked 'January 1, ___.'

- Proceed to Question 1, where you need to input the North American Industrial Classification System (NAICS) code for each specific activity along with a descriptive explanation.

- For Questions 6A to 6D, select and complete the applicable section that details the relevant eligibility scenarios regarding real estate.

- In Question 7, list the amounts for the exemptions you are claiming on eligible property as of January 1, ensuring that you provide supporting documentation.

- Question 8 pertains to leased assets. Complete this question according to the conditions of the leasehold equity to qualify for the exemption.

- On the signature page (Page 4), ensure you sign and notarize correctly. If a representative other than a company officer is signing, include Form BT-129 Power of Attorney.

- On Page 5, complete the State of Oklahoma Employment Level and Payroll Affidavit, following the provided instructions carefully.

- On Page 6, complete the Personal Property Appraisal Worksheet. List out all tangible and intangible personal property accurately, including item numbers and descriptions.

- Once finished, review all entries for accuracy, then save your changes, download, print, or share the completed form as needed.

Complete your Form 900-XM application online today for a seamless filing experience.

Homestead property valuation shall be frozen by the County Assessor if the following conditions exist: The property owner must be age 65 or over as of January 1st to qualify.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.