Loading

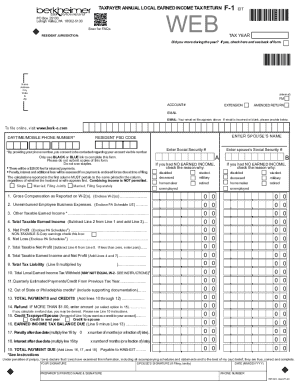

Get Earned Income Tax Return F-1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Earned Income Tax Return F-1 online

Filing your Earned Income Tax Return F-1 online can streamline the process of declaring your local earned income taxes. This guide will provide you with step-by-step instructions to ensure your form is completed accurately and submitted efficiently.

Follow the steps to successfully complete the Earned Income Tax Return F-1 online.

- Click ‘Get Form’ button to access the Earned Income Tax Return F-1. This will allow you to open the form for completion.

- Enter your personal information in the designated fields, including your name, address, email, and phone number. Ensure that all information is correct to avoid any issues.

- If applicable, indicate whether you moved during the tax year by checking the appropriate box.

- Select your filing status: Single, Married Filing Jointly, or Married Filing Separately. Enter the corresponding Social Security number for yourself and your spouse if applicable.

- Fill out Line 1 with your gross compensation as reported on your W-2 forms. Ensure you enclose these documents as required.

- For Line 2, enter any unreimbursed employee business expenses and include PA Schedule UE documentation if available.

- Complete Line 3 by including any other taxable earned income not reported in previous lines.

- Calculate your total taxable earned income for Line 4 by subtracting Line 2 from Line 1 and adding Line 3.

- If applicable, provide your net profit or loss from business operations in Lines 5 and 6, and make sure to include all necessary documentation.

- Proceed to calculate your total taxable earned income and net profit for Line 8 by adding Lines 4 and 7.

- Determine your tax liability on Line 9 by multiplying Line 8 by the tax rate indicated on the form.

- Complete Line 10 with the total local earned income tax withheld as per your W-2 forms.

- Add any quarterly estimated payments or credits from the previous year in Line 11.

- If applicable, provide any out-of-state or Philadelphia credits in Line 12, ensuring proper documentation is included.

- Sum all payments and credits on Line 13.

- If there is a refund, calculate it on Line 14, or indicate the amount you want to credit to your account on Line 15.

- Calculate the earned income tax balance due on Line 16. If applicable, include any penalty or interest charges on Lines 17 and 18.

- Finalize by adding Lines 16, 17, and 18 for total payment due on Line 19. Save your changes, and download, print, or share the filled form as needed.

Complete your Earned Income Tax Return F-1 online today for efficient processing!

2. Who must pay this tax? Any resident of a municipality and/or school district who was employed during the calendar year, and/or received taxable income during the calendar year is subject to the tax. In most cases, your employer already deducts the EIT from your regular paycheck.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.