Loading

Get Instructions For Form Et-133 Application For Extension Of Time ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the instructions for form ET-133 application for extension of time online

Filling out the ET-133 application for extension of time to file and/or pay estate tax can be straightforward if you follow the right steps. This guide provides clear instructions to assist you in completing the form online, ensuring all necessary details are accurately entered.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your online editing tool.

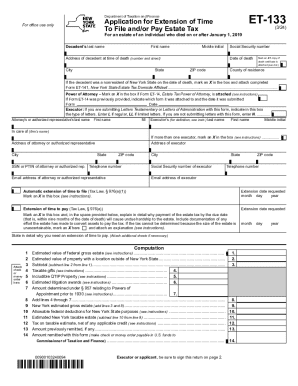

- Provide the decedent's information, including their last name, first name, middle initial, and Social Security number. Enter the address at the time of death along with the date of death. If applicable, mark an X if a copy of the death certificate is attached.

- Specify if the decedent was a non-resident of New York State on the date of death by marking an X in the designated box. If this applies, remember to attach completed Form ET-141, New York State Estate Tax Domicile Affidavit.

- If you are submitting Power of Attorney, mark the box indicating that Form ET-14 is attached. If Form ET-14 was previously provided, indicate the form it was attached to along with the submission date.

- Identify the executor of the estate. If you are submitting Letters Testamentary or Letters of Administration, enter the type of letters. If no letters are submitted, input ‘N’.

- Fill in the name, email address, and contact information for both the attorney or authorized representative and the executor. Ensure that all sections are completed accurately.

- Indicate whether you are requesting an automatic extension of time to file by marking the appropriate box.

- Clearly specify the extension date you are requesting using the provided fields (month, day, year).

- For extensions of time to pay, mark the box and provide a detailed explanation of why meeting the payment deadline will cause undue hardship to the estate. Include documentation of efforts made to convert assets for tax payment.

- Conduct a computation of the gross estate values as outlined in the form. Provide accurate figures for each line item and ensure to attach any necessary checks or payment information.

- Review the certification section at the bottom of the second page. Ensure that you sign and date the form where indicated, and mark the applicable role for yourself (e.g., attorney, executor, power of attorney).

- Finally, save changes to your form, download a copy for your records, print the completed application, or share it with relevant parties as necessary.

Complete your ET-133 application online today for a smooth filing process.

Where to mail your income tax return New York Form IT-201 Resident Income Tax Return Receiving a Refund Making a Payment State Processing Center PO Box 61000 Albany NY 12261-0001 State Processing Center PO Box 15555 Albany NY 12212-5555 https://.tax.ny.gov/pit/file/return_assembly_mail.htm

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.