Loading

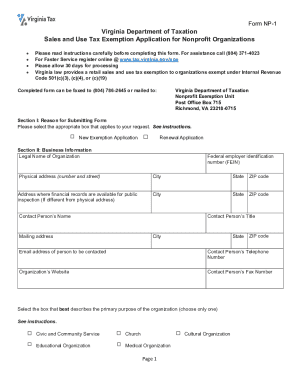

Get Form Np-1, Sales And Use Tax Exemption Application For Nonprofit Organizations

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form NP-1, Sales And Use Tax Exemption Application For Nonprofit Organizations online

Filling out the Form NP-1 for sales and use tax exemption can be an essential step for nonprofit organizations seeking financial relief. This guide will provide you with a clear, step-by-step approach to completing the form online, ensuring you include all necessary information for a successful application.

Follow the steps to complete the NP-1 form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section I, reason for submitting the form, select the appropriate box indicating whether you are submitting a new exemption application or a renewal application.

- Proceed to Section II, business information. Fill in the legal name of your organization, federal employer identification number (FEIN), physical address, contact details, and the organization's website.

- If your organization is a church, refer to Section III, where you should select either Option 1 or Option 2 for the nonprofit church exemption.

- In Section IV, exemption type, select the appropriate classification that best describes your organization's purpose from the provided list.

- Moving on to Section V, provide financial information including total annual gross revenue, fundraising expenses, and administrative expenses for the previous year. Attach additional documentation if your revenue is less than $5,000.

- Section VI asks if the organization intends to make purchases in Virginia. Answer yes or no and provide the estimated total dollar amounts for the current and previous year.

- In Section VII, indicate whether you are required to file a federal form 990. Provide the due date or attach prior year's financial statements as required.

- Section VIII is about solicitation laws. Indicate if contributions will be solicited in Virginia and attach proof of registration if applicable.

- Finally, complete the signature section, certifying that the financial information provided is true and accurate. Ensure you follow the checklist of requirements to confirm all necessary documents are included.

- Once all sections are completed, save any changes, download the form if needed, print for mailing or faxing, or share digitally if required.

Start filling out your Form NP-1 online today to take advantage of the exemption benefits for your nonprofit organization.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you're entitled to a certificate because of your medical condition, speak to your GP or doctor. They'll give you an application form. You'll get a certificate in the post within 10 working days of us receiving your application.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.