Loading

Get Tx 25.25rp - Harris County 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 25.25RP - Harris County online

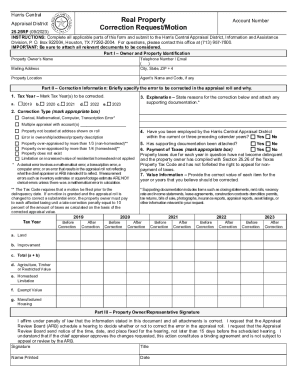

Filling out the TX 25.25RP form is essential for correcting errors in the appraisal roll in Harris County. This guide provides step-by-step instructions to help you complete the form accurately and efficiently, ensuring your request is properly submitted.

Follow the steps to fill out the TX 25.25RP form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, fill in the property owner's name, mailing address, telephone number, email, city, state, and ZIP code. Ensure that this information is current and accurate.

- Move to Part II, where you will specify the correction information. Indicate the tax year(s) to be corrected by marking the appropriate boxes.

- Provide a brief explanation of the error you are correcting and attach supporting documents, if necessary.

- Answer the question regarding employment with the Harris Central Appraisal District by marking 'Yes' or 'No'.

- Confirm if supporting documentation has been attached by marking 'Yes' or 'No'.

- Indicate whether property taxes due for each year in question have not become delinquent by marking the appropriate box.

- In the 'Value Information' section, enter the correct value for land, improvements, and total value for each applicable year, ensuring that all information is entered as accurately as possible.

- Proceed to Part III, where you will sign and date the form, affirming that all information provided is correct.

- Once all fields are completed, save changes, download, print, or share the form as necessary before submitting it.

Complete your correction request by submitting the TX 25.25RP form online today.

A 20% optional homestead exemption is given to all homeowners in Harris County. If the value of your home is $100,000, applying the exemption will decrease its taxable value for Harris County taxes from $100,000 to $80,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.