Loading

Get Claiming On Your Tax Return However, If You Wish To

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Claiming On Your Tax Return However, If You Wish To online

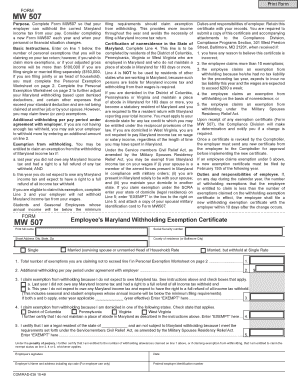

Filling out the Claiming On Your Tax Return However, If You Wish To form is an important process for ensuring that the correct amount of Maryland income tax is withheld from your pay. This guide offers step-by-step instructions to help users navigate the form easily and efficiently.

Follow the steps to complete your tax return successfully.

- Click ‘Get Form’ button to obtain the Claiming On Your Tax Return However, If You Wish To form and open it in the editor.

- Begin by entering the total number of personal exemptions you plan to claim on line 1. Make sure to review if you need to complete the Personal Exemption Worksheet on page 2 to determine if additional exemptions are necessary.

- If you need to have more tax withheld from your pay, enter that additional amount on line 2. This step allows you to control your tax withholding based on your financial situation.

- Evaluate if you qualify for exemption from withholding by checking the relevant criteria and completing line 3 accordingly. Ensure you meet both conditions outlined in the form to claim this exemption.

- For those who are residents of certain nearby states, complete line 4 to assert your nonresidency status if applicable. This helps clarify your tax obligations in Maryland.

- If applicable, enter your domicile state on line 5 and provide your spousal military identification information if you are claiming exemption under the Service members Civil Relief Act.

- Finally, review all entered information for accuracy. Once confirmed, you may save your changes, download, print, or share the completed form as needed.

Start completing your Claiming On Your Tax Return However, If You Wish To form online today!

Make sure your dependent meets the IRS requirements. Generally, the IRS requires that the child is under the age of 19 (or under 24 if a full-time student), lives with you for more than half the year, and does not provide more than half of their own financial support.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.