Loading

Get Frequently Asked Questions For Listing Business Personal Property

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Frequently Asked Questions For Listing Business Personal Property online

This guide provides clear, step-by-step instructions for completing the Frequently Asked Questions For Listing Business Personal Property form online. Users with varying levels of experience can follow these instructions to navigate the form effectively and ensure accurate reporting.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

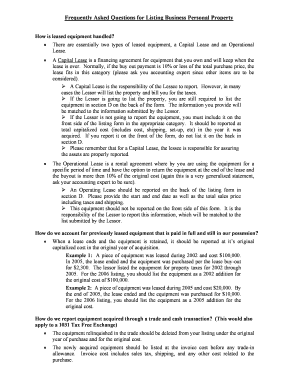

- Review the information required in each section of the form, starting with the introductory details. Ensure you understand the distinctions between Capital Lease and Operational Lease, as these will influence how you report your leased equipment.

- In section A, describe your business and provide necessary identification details, including your business name and address.

- For equipment under a Capital Lease, if the Lessor is reporting the property, list the equipment in section D and ensure it matches the Lessor's information. If the Lessor is not reporting, include it on the front side of the form.

- For equipment under an Operational Lease, only enter it in section D, including the start and end dates along with the total sales price.

- If you have equipment retained from a previous lease, report it at its original acquisition cost in the corresponding year on the form.

- List any equipment acquired through trade or cash transactions correctly, ensuring to delete any relinquished equipment from your records.

- If equipment has been expensed rather than capitalized, record it as an asset purchase, and if applicable total under the supply line.

- For any leasehold improvements, itemize them carefully, ensuring to categorize them accurately and report only improvements made in the prior year.

- Before finalizing, ensure that you have retained necessary records including financial statements and receipts.

- After filling in all applicable fields and reviewing your entries for accuracy, you can save your changes, download the form, print it, or share it as needed.

Complete your listings accurately and promptly to avoid penalties!

True or false: Personal property can be business property or personal-use property. True; Personal property is simply tangible property, other than real property. It may be used in a trade or business or it may be used personally.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.