Loading

Get Official Bad Check Form - Sfcgov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Official Bad Check Form - Sfcgov online

Completing the Official Bad Check Form - Sfcgov online can be straightforward with the right guidance. This user-friendly guide will walk you through each section of the form to ensure you provide the necessary information accurately.

Follow the steps to successfully complete the Official Bad Check Form online.

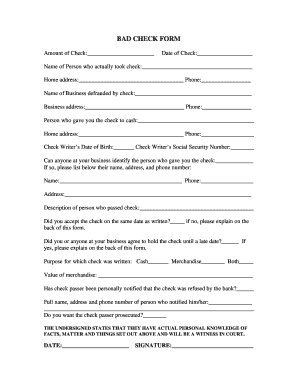

- Press the ‘Get Form’ button to access the Official Bad Check Form and open it in your preferred editor.

- In the first section, enter the amount of the check in the designated field. Ensure the figure is accurate to avoid any issues.

- Provide the date on which the check was written in the specified field. This is crucial for validating the transaction.

- Fill in the name of the person who actually presented the check for cashing. This identification is important for any follow-up actions.

- Next, input the home address and phone number of the individual who presented the check. This information may be needed for contact purposes.

- Record the name and address of the business that was defrauded. Don’t forget to include a phone number for future communication.

- Identify the person who issued the check. Provide their name, home address, and phone number in the respective fields.

- Input the check writer's date of birth and social security number. This information is necessary for legal identification.

- Indicate whether anyone at your business can identify the check presenter. If yes, list their name, address, and phone number.

- Describe the individual who passed the check in the provided description field.

- Answer whether you accepted the check on the date written. If the answer is no, explain the circumstances on the back of the form.

- State whether there was an agreement to hold the check until a later date. If yes, provide an explanation on the back of the form.

- Select the purpose for which the check was written (cash, merchandise, or both) and note the value of any merchandise involved.

- Confirm whether the check passer has been notified about the check being refused by the bank. If so, provide the name, address, and phone number of the notifying person.

- Indicate if you wish to proceed with prosecuting the check passer. This decision is important for recording legal actions.

- Finally, sign and date the form to confirm the information you've provided is accurate. You may now save your changes, download, print, or share the completed form.

Complete your documents online for a more efficient process.

The Demand Letter Your demand letter must request that you be paid the full amount of the check, any bank fees and the cost of mailing the demand. It also tells the person who gave you the bad check, that if they do not pay within 30 days of your mailing the demand letter, you can sue for the check plus damages.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.