Loading

Get Affidavit For Exemption Of Taxes On Modification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the affidavit for exemption of taxes on modification online

Navigating the affidavit for exemption of taxes on modification can seem challenging, but this guide will provide you with clear steps to complete the process online with ease. Understanding each component of the form is essential for accurate completion and timely filing.

Follow the steps to successfully complete your affidavit online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

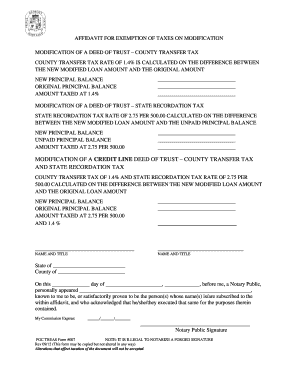

- In the first section, you will encounter fields related to the modification of a deed of trust. Enter the new principal balance and the original principal balance in the designated spaces. The form will calculate the county transfer tax based on these values.

- Move to the next section, which addresses the state recordation tax. Again, provide the new principal balance along with the unpaid principal balance. The form will calculate the necessary tax based on the difference between these amounts.

- For modifications involving a credit line deed of trust, ensure that you complete all relevant fields, including the new principal balance and the original loan amount. This section will also compute both county transfer and state recordation taxes for your review.

- At the bottom of the form, include the name and title of the individuals involved in the affidavit. Then, enter your state and county information along with the date of signing.

- Once everything is filled out, ensure that the form is ready for notarization. A notary public will need to witness the signing, so leave space for their signature and expiration date of their commission.

- Finally, review all entered information for accuracy before proceeding. After confirming the details, you can save changes, download a copy, print the form, or share it as needed.

Begin filling out your affidavit online today to ensure a seamless tax exemption process.

Sellers are required to charge sales tax on all transactions subject to tax except when a jurisdiction's rules allow for the sale to be made tax-exempt. An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.