Get Al Dor Form E00 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

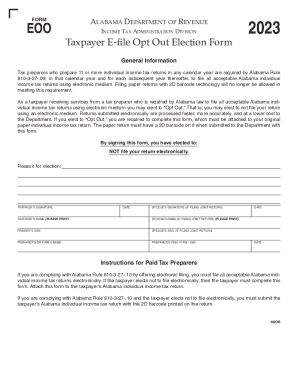

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:Choosing a authorized specialist, creating a scheduled appointment and coming to the office for a personal conference makes doing a AL DoR Form E00 from start to finish tiring. US Legal Forms enables you to rapidly generate legally valid documents according to pre-constructed online blanks.

Prepare your docs within a few minutes using our straightforward step-by-step instructions:

- Find the AL DoR Form E00 you require.

- Open it up using the online editor and begin editing.

- Fill the blank areas; engaged parties names, places of residence and phone numbers etc.

- Change the template with smart fillable fields.

- Include the particular date and place your electronic signature.

- Click on Done after twice-examining everything.

- Download the ready-produced record to your device or print it as a hard copy.

Easily produce a AL DoR Form E00 without having to involve experts. There are already over 3 million users benefiting from our rich catalogue of legal forms. Join us today and get access to the #1 collection of browser-based blanks. Give it a try yourself!

FORM 20C-C Alabama Consolidated Corporate Income Tax Return. The Form 20C-C must be filed by or on behalf of the members of the Alabama affiliated group in ance with Alabama Code Section 40-18-39, when a Consolidated Filing elec- tion has been made pursuant to Code Section 40-18-39(c).

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.