Loading

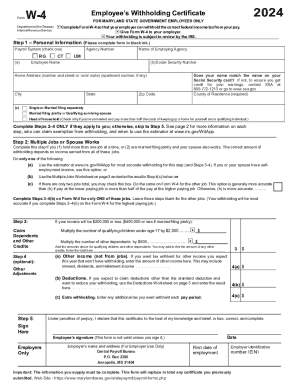

Get Md W-4 2024-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:The preparing of legal paperwork can be high-priced and time-consuming. However, with our pre-built online templates, everything gets simpler. Now, creating a MD W-4 requires no more than 5 minutes. Our state-specific online samples and complete instructions eradicate human-prone errors.

Follow our easy steps to get your MD W-4 prepared quickly:

- Choose the web sample from the library.

- Type all necessary information in the required fillable areas. The user-friendly drag&drop interface makes it simple to include or move areas.

- Make sure everything is completed correctly, without typos or missing blocks.

- Use your electronic signature to the PDF page.

- Click Done to confirm the alterations.

- Download the document or print your PDF version.

- Submit immediately towards the recipient.

Make use of the fast search and powerful cloud editor to generate an accurate MD W-4. Clear away the routine and create documents online!

Maryland income tax withholding Maryland's income tax rate ranges from 2% to 5.75%, based on the employee's income and filing status with some exceptions for retirees. Employees who receive Social Security benefits, for instance, are exempt from taxation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.