Loading

Get 2009 Form 5s - Wisconsin Tax-option (s) Corporation Franchise Or Income Tax Return (pdf Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2009 Form 5S - Wisconsin Tax-Option (S) Corporation Franchise Or Income Tax Return (pdf Fillable online

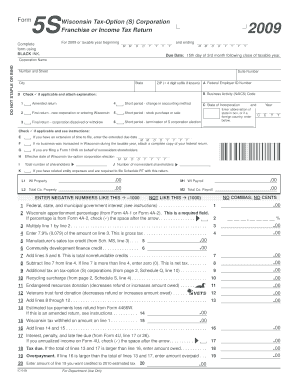

Filling out the 2009 Form 5S for Wisconsin is crucial for tax compliance for S Corporations operating in the state. This guide will provide all necessary steps to accurately complete this form, ensuring your submission is effective and complete.

Follow the steps to fill out the 2009 Form 5S accurately and efficiently.

- Click ‘Get Form’ button to download the form and open it in your preferred PDF editing software.

- Complete the corporation's name and address in the spaces provided. This includes the number and street, suite number (if applicable), city, state, and ZIP code. Additionally, provide the Federal Employer Identification Number.

- Indicate the corporation's current status by checking the appropriate boxes, such as if it's an amended return or the first return. Provide the applicable NAICS code for the business activity.

- Enter the taxable year dates in the specified format, ensuring the correct year is indicated.

- Fill out the sections related to shareholders, including total number of shareholders and number of nonresident shareholders.

- For financial information, input figures related to Wisconsin property and payroll accurately. Follow the format rules provided (e.g., no commas, no cents).

- Complete the revenue and tax calculations as outlined in the financial sections. Enter amounts from other forms where indicated, ensuring accurate multiplication and percentage calculations.

- Review the credits available, such as the manufacturer’s sales tax credit and enter values as required.

- Confirm your tax obligations by calculating any interest, penalties, or surcharges based on previous lines.

- Affirm the correctness of your return by providing signatures from both the officer and the preparer, along with the corresponding dates.

- To finalize, save all changes, download the completed form, print it for records, or share it if necessary.

Complete your tax documents online today for a smoother filing experience.

Wisconsin Form 5S is a form used for filing a Wisconsin state income tax return for part-year residents and nonresidents. It is important to read the instructions for completing the form before filing. Instructions for completing Form 5S can be found on the Wisconsin Department of Revenue website.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.