Loading

Get Emphasize Exempt Duties In Your Job Descriptions For Exempt...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Emphasize Exempt Duties In Your Job Descriptions For Exempt... online

This guide provides a clear and supportive approach to completing the Emphasize Exempt Duties In Your Job Descriptions For Exempt... form online. Whether you have extensive experience or are a newcomer to digital document management, these step-by-step instructions will help you accurately fill out the required fields.

Follow the steps to effectively complete the form

- Press the ‘Get Form’ button to obtain the form and access it in the online editor.

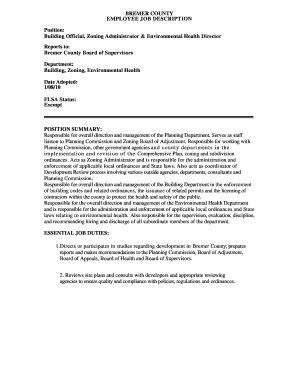

- Begin by filling in the position title, ensuring it reflects the job accurately, such as 'Building Official, Zoning Administrator & Environmental Health Director'.

- Indicate the department by entering 'Building, Zoning, Environmental Health', which provides context for the role.

- Record the adoption date, which is important for keeping the job description current.

- Specify the FLSA status as 'Exempt' to classify the position accordingly.

- In the position summary, summarize the key responsibilities and the scope of the role clearly, ensuring clarity for future reference.

- List essential job duties by numbering them and using clear, action-oriented language to describe each responsibility.

- Detail the entry requirements and knowledge, skills, and abilities required for the job. Use bullet points for clarity.

- Outline the physical requirements associated with the job to ensure candidates are aware of the demands.

- Describe the work environment, noting any relevant working conditions and expectations.

- At the end of the form, provide a section for employee acknowledgment, including a place for the signature and date.

- Once all sections are completed, review the document for accuracy. You can then save your changes, download, print, or share the form as needed.

Complete your job descriptions online today to ensure clarity and compliance!

Companies often classify salespeople and commissioned employees as exempt. But these professionals must meet two key requirements: An employee earning commission must earn over one and a half times the California minimum wage. An employee's commissions must make up more than half of their overall compensation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.