Loading

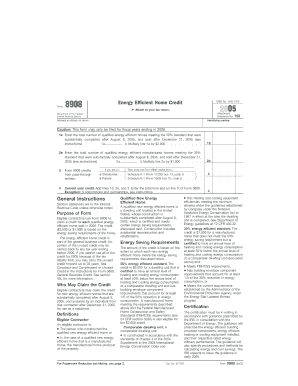

Get 2005 Form 8908. Energy Efficient Home Credit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2005 Form 8908. Energy Efficient Home Credit online

This guide provides a detailed, step-by-step process for completing the 2005 Form 8908, utilized to claim the Energy Efficient Home Credit. Designed for eligible contractors, the form captures essential information about energy efficient homes and helps assist users in achieving tax credits for their environmentally friendly constructions.

Follow the steps to complete the form effectively and accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name(s) as shown on your tax return in the appropriate field at the top of the form. Ensure correct spelling and format.

- Input your identifying number in the specified field. This is typically your social security number or employer identification number.

- For Line 1a, enter the total number of qualified energy efficient homes that have been substantially completed after August 8, 2005, and sold after December 31, 2005. The total should reflect only those homes meeting the 50% energy efficiency standard.

- In Line 1b, multiply the amount from Line 1a by $2,000, representing the allowable credit for those homes.

- For Line 2a, record the total number of qualified energy efficient manufactured homes that have been substantially completed after August 8, 2005, and sold after December 31, 2005, adhering to the 30% energy efficiency standard.

- In Line 2b, multiply the number from Line 2a by $1,000 to calculate the credit for these manufactured homes.

- If applicable, for Line 3, report the Form 8908 credits that were allocated to you as a shareholder or partner from a pass-through entity.

- On Line 4, add the amounts from Lines 1b, 2b, and 3 to determine your current year credit, and enter the total here.

- Finally, review your completed form for accuracy. Save your changes, and download, print, or share the form as needed for your tax return.

Complete your documents online today to take advantage of the Energy Efficient Home Credit.

More In Forms and Instructions Eligible contractors use Form 8908 to claim a credit for each qualified energy efficient home sold or leased to another person during the tax year for use as a residence.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.